Paying off a car loan is a long process that requires you to remain dedicated to your budget as you pay your monthly bills. Sometimes, though, whether through access to extra cash to make extra payments, refinancing of your current loan, or just making sound decisions when taking on the loan in the first place, you can lower your finance charges, significantly in some cases. Before deciding on a course of action, consider discussing the options available with your car loan lender to make sure they are viable.

Method 1 of 3: Use pre-payment to pay off your loan early

Materials Needed

- Calculator

- Current loan agreement

- Pen and paper

Pre-payment allows you to pay off your loan at an earlier time than originally agreed upon. You do this by making extra payments on a monthly basis with the extra amount designated to go toward the principle. Before proceeding, though, you should make sure that you have the extra cash available to make pre-payment possible and that your lender allows you to use pre-payment with your car loan.

- Tip: The best way to reduce the amount you have to pay off is to have good credit before you even take out a loan. Depending on whether you have great, or just moderately good, credit can mean the difference of thousands of dollars in extra finance charges common with a higher interest rate.

Step 1: Determine the viability of pre-paying your loan. While methods such as refinancing might not be available to you due to your current credit, paying a higher monthly payment could allow you to cut down the principal you owe.

The principle is the most important determining factor when figuring how much you ultimately end up paying over the life of the loan. Reducing this at a quicker rate should reduce the amount you owe.

- Warning: Before pre-paying any amount on your current car loan, make sure that there is no penalty for paying your car loan off early. If you are unsure about any prepayment penalties specific to your loan, consult with the lender to find out more about your car loan.

Step 2: Refer to principal-only payments. Once you have learned that your lender allows you to pay off your car loan early without penalty, find out the process they use before doing so.

Often referred to as principal-only payments, make sure to let your lender know that is what the additional money is for.

- Note: Some lenders even require that you make such payments separately from your normal monthly payment.

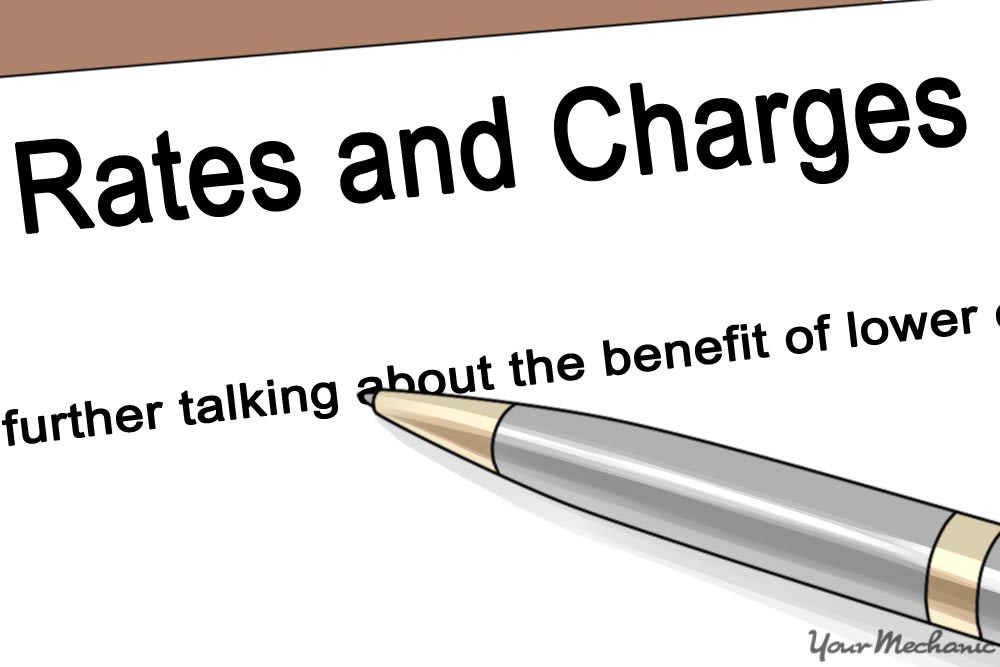

Step 3: Calculate your monthly payoff. After learning the process you must follow to pay off a loan early through pre-payment, figure out how much extra you need to pay each month for an early payoff.

You can use a calculator to figure this amount out, or use an online calculator. Some sites that offer free car loan payoff calculators include Wells Fargo, Calxml. com, and Bankrate.

Method 2 of 3: Cut out the middle man

When shopping for a car, make sure to check out all of the options available before taking out a loan. While the dealership might present a convenient option when trying to acquire the cash necessary to take out a car loan, they often act as a middleman between you and the actual lender, adding on fees for the service. In addition, needing only a small loan could increase your finance charges considerably as the lender tries to make money off the smaller loan.

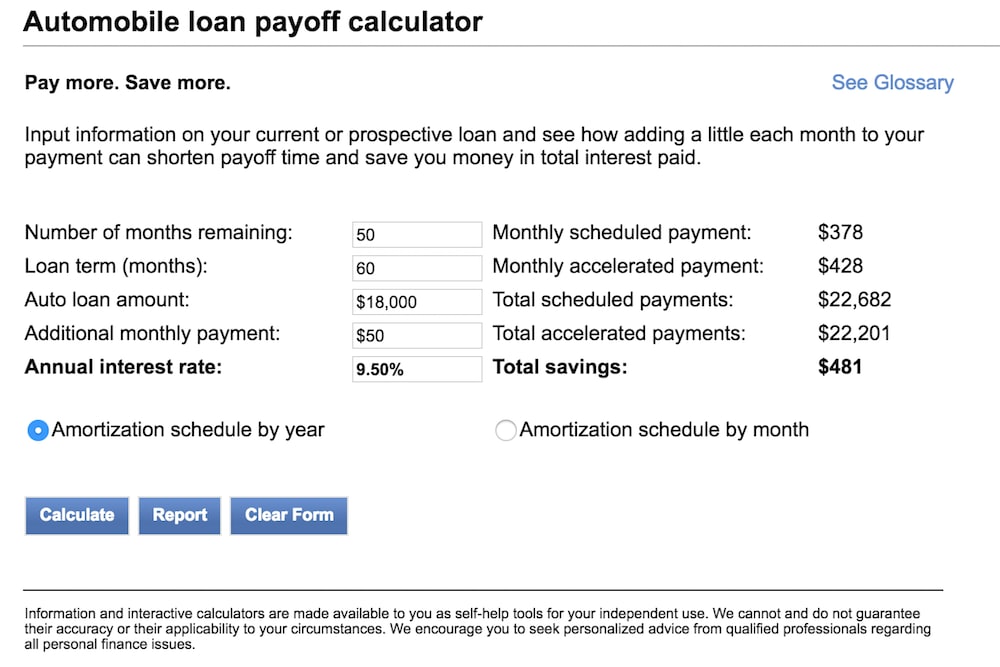

Step 1: Know your score: Learn your credit score before approaching a lender for a car loan. Know what type of interest rate your specific credit score can gain you is important.

Everyone is entitled to a free credit report from one of three credit bureaus every year. Contact Experian, Equifax or TransUnion for copy of your report. You can also get a copy at AnnualCreditReport.

Once you know your score, you can see how it stacks up:

Below 550 is a bad score, getting a loan for a car will be difficult or impossible. Financing will likely result in a very high interest rate.

Between 550 and 680 is sub-prime, so it’s not great but it’s definitely something to work with.

Scores above 680-700 are considered “prime” and will result in the best interest rates. If your score is below 680, then buying a car responsibly and making regular payments can really bump the score up.

Note: Car dealers are not going to examine your credit report, they will only pull your score.

Step 2: Research the various financing options available to you. This includes traveling to the bank or other financial institution to discuss if the bank is able to help you.

Often this is determined by how good your credit is. By going directly to the bank or credit union, you can cut out many of the middle man fees associated with taking out a loan at the dealership.

Step 3: Pay with cash if you can. If you only need a loan for a few thousand dollars, you are better off waiting, if possible, and paying cash for a car. Most lenders are in the market to make a small amount in addition to what they lend. When the amount is small in comparison, the lender usually charges higher finance charges to offset the lower amount.

- Tip: If your credit score is too low, you should consider improving it before taking out a car loan. One step you can take is to work with a credit counseling organization to rebuild your credit over time. The organization will assist you in such things as setting up a budget and helping you determine the best way to pay off your debt, though most charge for their services.

Method 3 of 3: Refinance your loan

Another great way to reduce the amount of finance charges you have to pay is to refinance your current car loan. Before taking out the original loan, make sure that lender allows refinancing, as some do not. Then, if you decide to go this route, you will know beforehand what your options are.

Step 1: Gather your paperwork. After contacting your lender, you need to gather information specific to your car loan. Having the following information handy should make the whole refinancing process easier, including:

- Your credit score

- The interest rate on your current car loan

- How much you owe on the current loan

- The number of payments you have remaining

- The value of your vehicle

- The make, model, and odometer reading

- Your employment history and your yearly income

Step 2: Compare the terms. If you are eligible for refinancing, compare the terms of what your current lender is offering with those of other financial institutions.

Keep in mind the length of the new loan, the new interest rate, any penalties for prepayment and late payment, and any additional fees or finance charges.

Once you are satisfied with the terms, only then should you agree and sign the paperwork.

- Warning: You should also determine if there are any conditions for repossession of the vehicle and what they are before signing. It is a little too late to learn that there is some special stipulation that you missed when the lender comes to repossess your car.

Refinancing your current car loan is a great way to reduce your current payment, including any finance charges. Make sure to keep you vehicle in good running condition to ensure it lasts for the life of your loan and beyond. This includes performing routine maintenance inspections and repairs. Let our expert mechanics help you maintain your vehicle to ensure your car stays in prime condition.