Typically, you don’t have the whole purchase price in cash when you purchase a vehicle. When that happens, you can set up a loan with a financial institution or lender to borrow the funds you need to pay for the vehicle. When you set up that loan, you need to make payments against the borrowed amount.

Car loan payments are usually arranged with the individual lender. There are certain criteria set up that you agree to including:

- A set term length for the loan

- Interest charges for the borrowed amount

- A payment schedule weekly, bi-weekly, semi-monthly, or monthly.

- A set payment amount including principal and interest

There are a few ways you can make your car payment to your lender. Not all lenders operate under the same guidelines, so confirm each method with your lender before signing your loan agreement.

Method 1 of 5: Arrange a pre-authorized bank debit

A pre-authorized debit is an agreement with your bank to allow your lender to withdraw your car payment on a set schedule. Setting up your pre-authorized debit is easy and takes the stress out of making your car payment.

Step 1: Complete a pre-authorized debit form with your lender. This is done at the time you set up your car loan.

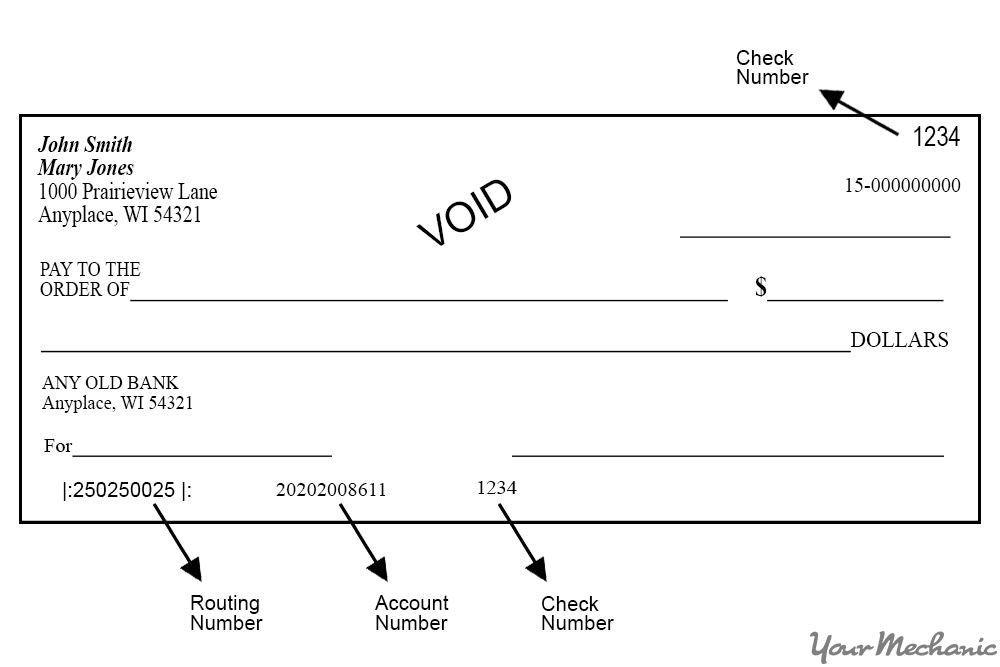

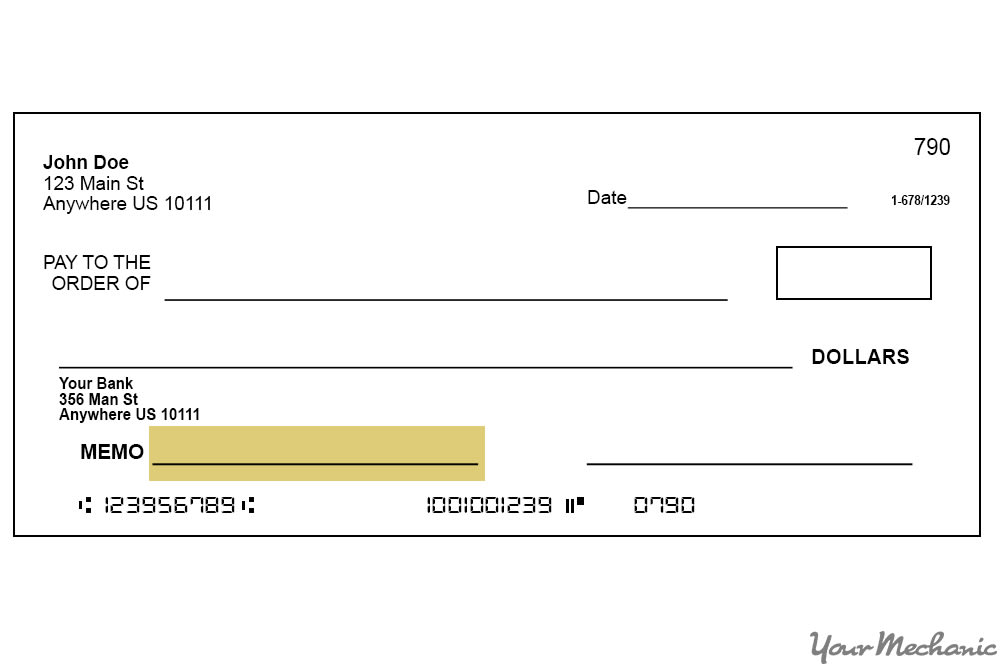

You’ll need your bank account number and your bank’s routing number for the form.

Your account number and routing number are on the bottom of your checks.

Alternatively, you can provide your lender with a voided check.

Step 2: Know the payment schedule. Know the pre-authorized payment amount that will be withdrawn and on what day.

Step 3: Make sure the money is in the account. Have the money for your payment in your account on the date it will be automatically withdrawn.

If you don’t have sufficient funds in your account, you can be assessed a returned payment fee from your bank and the lender and still have to make your car payment.

If you know you won’t have the money for your payment, talk to your lender at least three days before your payment date to make alternate arrangements, or to skip a payment if you’re able to.

- Note: If you skip a payment, it will extend your loan term by an extra payment cycle.

Method 2 of 5: Use your mobile phone to make a payment

You can use your mobile phone to make a payment from your bank on your car loan. You’ll need to have a method of payment arranged with the lender in case you don’t make your payment on time, much like a pre-authorized debit.

Step 1: Organize the payment. Make arrangements with your lender to pay your car payment yourself.

You’ll need to provide a credit card or alternate form of payment in the event you don’t make your car payment.

Sign your loan contract, agreeing to the terms of repayment.

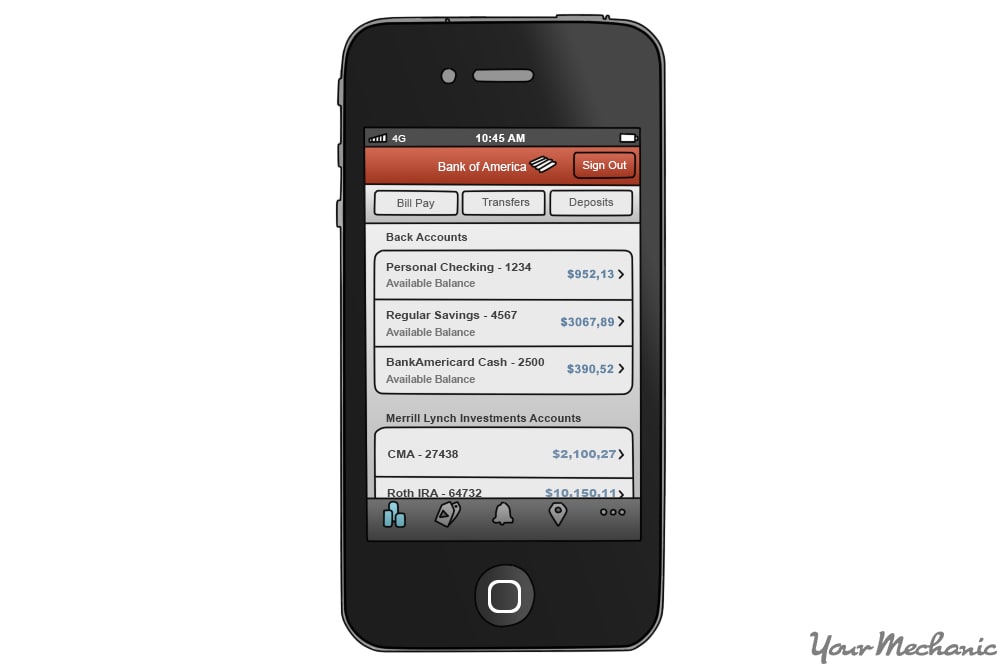

Step 2: Make your car payment on or before your due date. Use your mobile phone’s bank app or a browser on your phone to complete a payment to your lender.

If you know you won’t be able to make your payment on time, call your lender to make alternate arrangements.

If you miss a payment under this agreement, you may lose the option to pay your car payment yourself, and the pre-authorized debit agreement will take over.

Step 3: Make extra payments with your mobile phone. If you want to reduce your loan term or have extra income one month, you can pay an extra payment in the same fashion.

Method 3 of 5: Pay your car loan with an internet payment

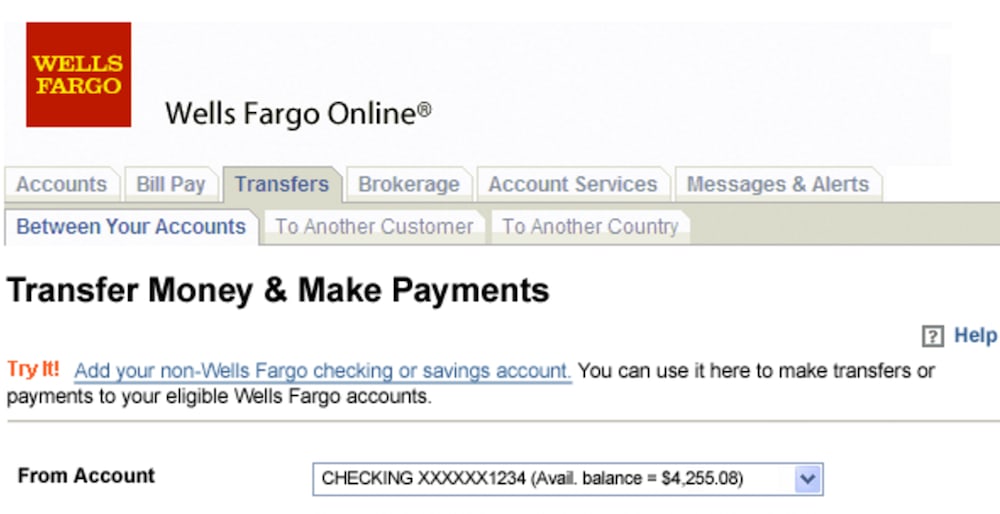

Many lenders including new car manufacturers have the option to complete payments on their website. You can log into your account and complete a payment with your savings or checking account.

Step 1: Make your loan arrangements. Organize loan details with your lender including repayment through the online platform.

You’ll need to have a backup form of payment in place in the event you don’t make your payments on time.

The backup payment method is usually a pre-authorized debit agreement.

Step 2: Know your repayment schedule and your payment amount. Pay on or before your due date each time.

Step 3: Log in. Locate your lender’s website and log into your account. You’ll need to register for an account if you haven’t done so already.

Step 4: Make a payment using your banking information.

Method 4 of 5: Pay your car loan with a wire transfer

You can pay your car loan with a wire transfer. This method is usually not recommended as there are extra fees when paying by wire transfer but is possible if you are unable to pay any other way. Also, you can pay with cash for your wire transfer.

Your car payment likely can’t be set up initially to be paid by wire transfer on a regular basis. It can be used to either prepay your payment or to make a missed payment.

Step 1: Find your account number with your lender. You’ll need your account number for reference when you complete the wire transfer, otherwise your payment may not be credited to your account.

Call your lender’s office to get your account number.

Advise the office you will be wiring a payment.

Step 2: Find the transfer information for your lender. It may be available on your lender’s website or you may have to ask for it over the phone.

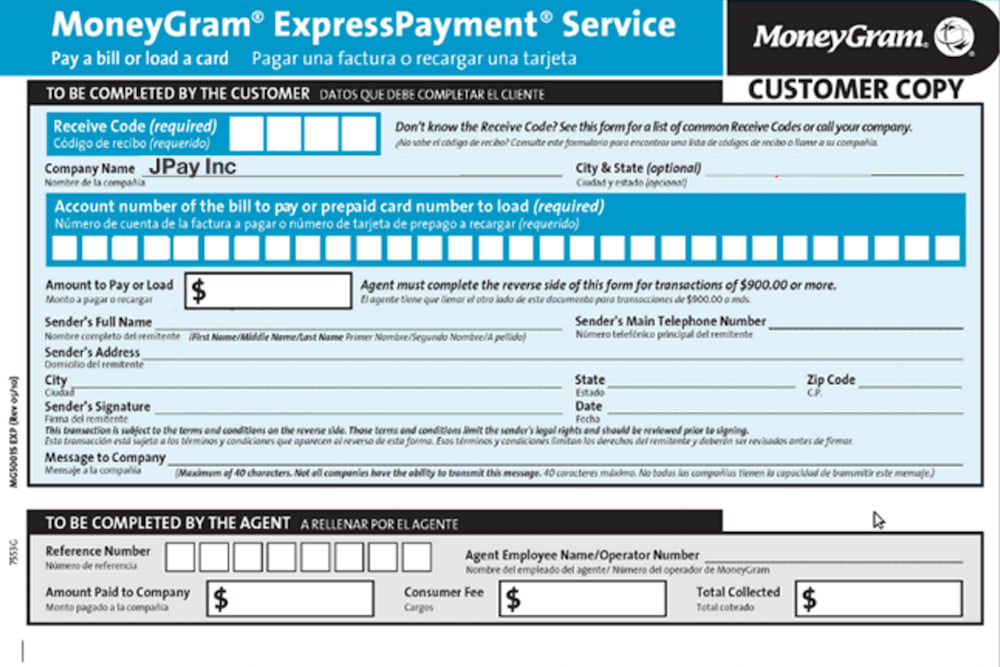

For MoneyGram, you’ll need a Receive Code, the Payee’s name along with city and state, and your account number.

For Western Union, you’ll need your account number, the payee’s name, their city, and their state.

Step 3: Make a payment via wire transfer. Attend either a Western Union or MoneyGram location in person, or online.

You can make cash payments in person only, or you can use your credit card to make a payment either online or in person.

Your payment will typically be received the next business day by your lender.

Method 5 of 5: Mail payment for your car loan

If you want to pre-pay your car loan, put a lump sum against your loan, or catch up on a missed payment, you can send payment by mail.

- Warning: Don’t send cash through the mail.

Step 1: Get the name right. Find the proper name to fill out on your method of payment.

Your lender may operate under a different name than the institution you send your payment to.

Step 2: Obtain your account number. Without your account number on your mailed payment, it may be impossible to credit the payment against your account.

Step 3: Fill in your method of payment. If you are paying by check or money order, make sure it is addressed properly.

Put your account number on your check or money order in the memo section.

Step 4: Address the envelope completely. Put the whole mailing address for the lender on the envelope in the middle.

Put your return address on the upper left corner in case the envelope gets returned undelivered.

Apply the correct postage to the upper right corner of the envelope.

Step 5: Seal your payment in the envelope and drop it in a mailbox. Your payment can take several days before it is delivered to your lender.

When choosing the best method of paying your car loans, be honest with yourself about how much control you want to have over the process every month. If you have a steady income and don’t want to have to think about payments, a pre-authorized debit system through your bank might be the best option for you. But if your income fluctuates or you want to remain in control of when payments get made, writing a check or submitting a payment electronically might work better for you.