There are a number of reasons that someone might have to want to get out of their car loan. Maybe their credit score was bad when they first got the loan, but then it improved over time. Maybe the terms agreed upon were not as sustainable as once thought.

Regardless of the reason, getting out of a car loan can be a straightforward process if you take all of the necessary steps. If you are looking to buy a new vehicle, you first have to do the legwork of taking care of your current one.

Part 1 of 4: Gather relevant information

Essential to getting a new car is establishing the value of your current car. Here is how to get a good idea of your car’s value.

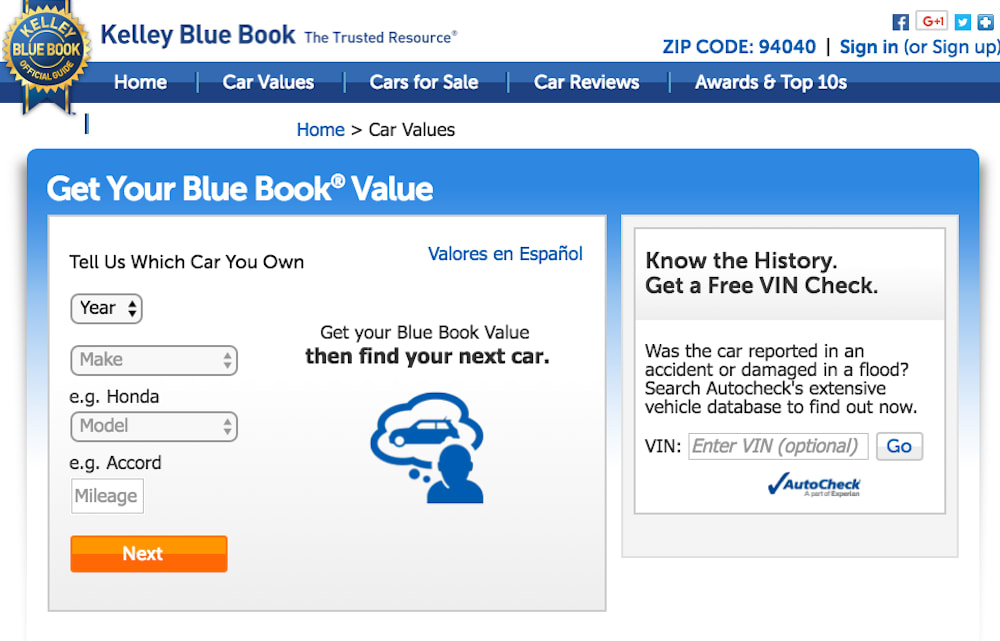

Step 1: Use websites to determine value. Look up the current value on a website such as the Kelley Blue Book or the NADA website.

These do not take into account every single factor that weighs into the value, but they cover basics like what a car with your specific trim and condition will usually go for.

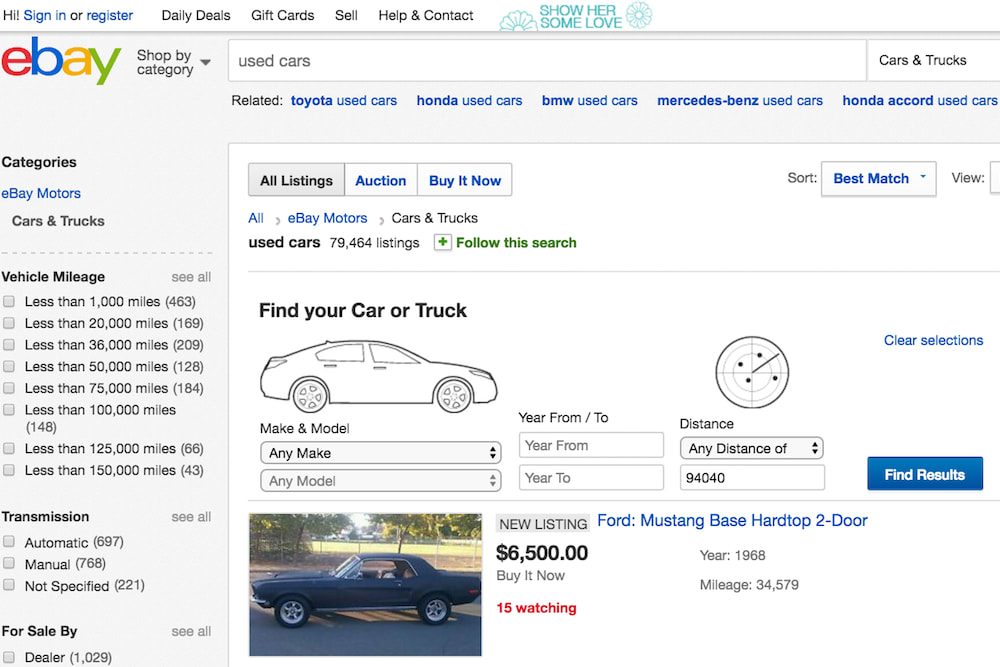

Step 2: Look at classified ads or eBay listings for similar cars. You can sometimes look up already sold vehicles in the classifieds or eBay.

This lets you see both what sellers are asking for and what customers are willing to pay.

Step 3: Contact local dealerships. Ask local dealerships what they would sell your car for used and what they would pay as a far as trade-in value.

Step 4: Determine an estimate. Take all of the numbers into account, and, based on the time of year and your location, figure out an accurate estimate of what your car is worth.

Step 5: Compare the amount owed to the car’s value. If your car is worth more than you owe, sell the car and pay off the loan.

The remaining cash can be used to purchase your next vehicle. You will get less money trading your car in when purchasing a new one, but you can avoid the time and money needed to sell the car privately.

- Tip: If the car is in good condition and needs no major repairs, try selling it privately. This will take more time and effort, but it may be the difference between paying off your loan and being upside-down.

Part 2 of 4: Consider what to do if you owe more than the value of the car

In many cases, when getting rid of a vehicle before it has been fully paid off, the amount of money owed is greater than the value of the vehicle. This is called an upside-down loan. This is a problem, since you cannot simply sell your car and pay off the loan.

Step 1: Reconsider the situation. The first thing to do if you find yourself “upside-down” on a car loan is to consider whether or not it may be advantageous to hold onto the car for a bit longer.

Consider that you will have to pay out of pocket for the remainder of the loan after the car’s value is subtracted. This cost will reduce what you would otherwise have to spend on a new car.

If you cannot cover the remainder of the loan, that means you will be paying off one car while trying to put a down payment on a new car, which will limit negotiating power when the time comes.

Step 2: Refinance the loan. Consider re-negotiating the terms of your existing loan.

Finding yourself in a situation where you cannot keep up with the payments on a loan is not an uncommon problem. Most lenders are fairly understanding if you contact them about refinancing your loan.

Regardless of what you end up doing, whether keeping the car or selling it, refinancing is beneficial. If you sell the car, you can pay off a big chunk of the loan and then have smaller payments over more time for the remainder.

- Tip: You may be able to keep the vehicle long enough to not be upside-down if you refinance and work out a payment plan that works with your budget.

Step 3: Transfer the loan to someone else. Depending on the terms of your specific loan, you may be able to transfer the loan to someone else.

This is a great solution if possible, but make sure that every part of the loan is transferred to the new owner’s name. If not, you may end up liable if they don’t make payments.

Part 3 of 4: Lease a new car

Depending on how much money you have on hand, it may be difficult to get out of a loan and straight into a new car. However, there are still several options for people with a steady income but no money to put down.

Step 1: Lease a car. This is a good option for someone who routinely exchanges their car for a new one.

In a lease, you make monthly payments to use the car for a few years, and then you give the car back after the lease is up.

Depending on who the original loan was through and who you would be leasing from, in some cases it is possible to add the negative equity from an upside-down loan to the overall cost of the leased car.

That means that monthly payments will contribute to both, though the payments would be more than just the leased vehicle.

Part 4 of 4: Obtain a car with no money down

Step 1: Make only monthly payments. Many dealerships offer deals where you can get into a car without putting money down, making monthly payments to eventually pay off the car.

The issue is that these deals often involve a higher interest rate, compounded by the fact that you will be paying for the interest on the entire price of the car.

- Tip: Negotiating on a car without putting money down on it is difficult, though if you trade in your car you will have more to bargain with.

Acquiring a new car and getting rid of your old one may seem like a daunting process, but it can actually be rewarding. If you go about it in the right way, you can make a good financial decision that helps you get into a new car at the same time. Be sure that before you get your new car, you have one of our certified techinicians perform a pre-purchase inspection.