You’ve saved some money to purchase a used car. And while you could use those funds to pay cash for a vehicle from an individual, you can also benefit from having money in hand when visiting a dealership. The cash can be a down payment on a newer model that comes with a warranty or lower mileage. For those who do not have the necessary cash on hand, multiple options for financing a used or pre-owned vehicle exist.

Part 1 of 4: Know your credit score

Before you even begin looking for financing for a pre-owned car, though, you need to find out one very important piece of information. Your credit score is the single most important factor when it comes to getting the best interest rates available.

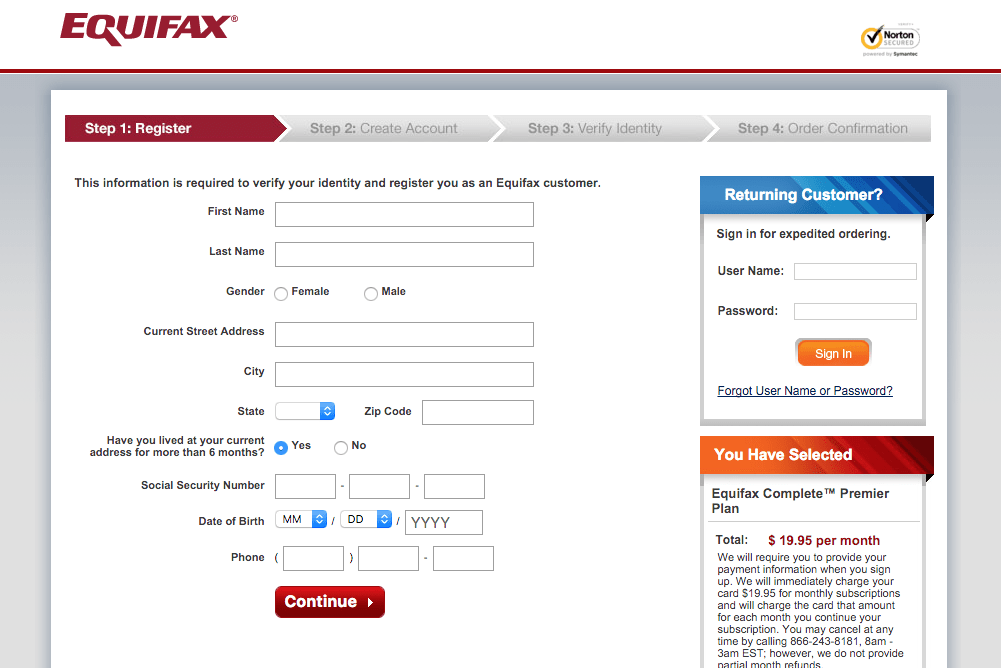

Step 1: Find out your credit score. Contact one of the three main credit agencies – Experian, TransUnion, and Equifax – to order a credit report.

You are entitled to one free credit report every 12 months from each of the three nationwide credit reporting agencies. Otherwise, you have to pay for the credit report.

Tip: If for some reason you are rejected for a loan due to credit reasons, you can ask for a free credit report from the agency that the lender received the credit check from. The lender must also give you instructions for how to receive your free credit report.

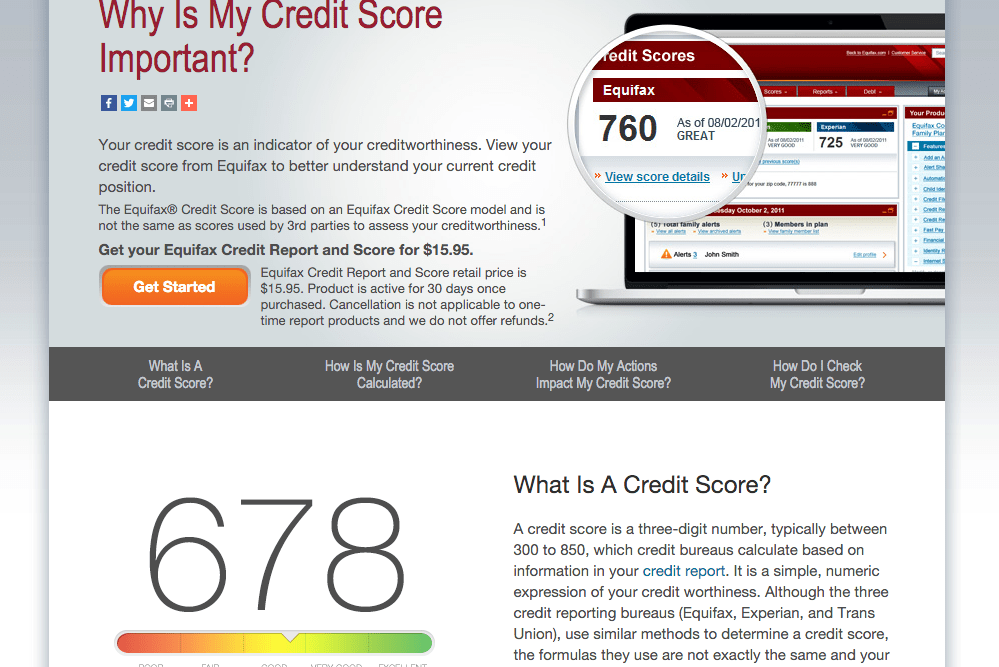

Once you get your credit report, look for your credit score. This number ranges from 300 to 850, with a higher number signifying a better score.

Note: A credit score of 621 is the lowest you can usually have to receive the best rates from lenders.

Step 3: Improve your score. If you have time before you need to purchase a vehicle, try to improve your credit score. Some of the ways to improve your credit score include:

Using a credit card occasionally. Make sure to pay your credit card bill on time or even pay any outstanding amount off.

Pay your other bills on time.

Avoid having a high balance on a credit card.

Keep unused credit card accounts open, as having fewer accounts can actually hurt your credit.

Part 2 of 4: Get a loan through a lender

Once you know your credit, it is time to seek out financing to purchase a pre-owned vehicle. Various lenders, such as banks, credit unions, and other financial institutions, make a business of lending money to buyers.

- Tip: Calculate your budget before searching for lenders so you know how much you can afford in payments. Make sure to include sales tax and other fees in the amount you need to budget for.

Step 1: Find a lender. Search for finance companies and lenders online who specialize in used cars. Enter the term “used car loans” and review the results.

Some online lenders, including Lendingtree, Capital One, and Wells Fargo.

You can also approach your bank or credit union to see what they have to offer.

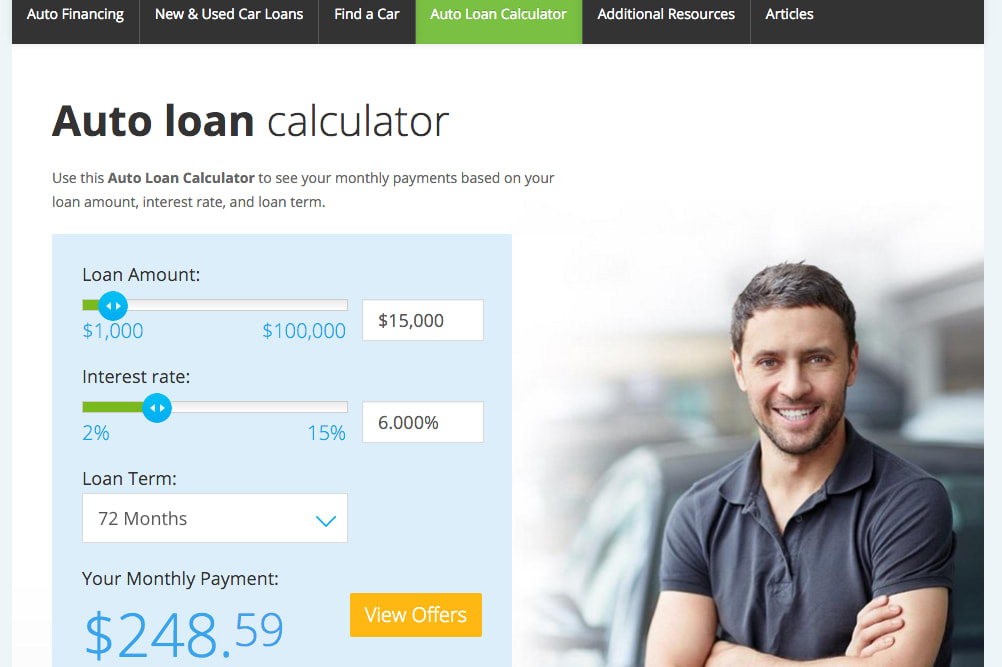

- Tip: Many online lenders offer an auto loan calculator, allowing you to figure what your monthly payment would be for different loan amounts at various interest rates and lengths. These calculators come in handy when trying to come up with a budget for a pre-owned vehicle purchase.

Step 2: Choose the best rate. Compare the terms offered by the various companies to see who offers the best interest rates. A low APR, or annual percentage rate, means that you have to pay less when paying off the loan.

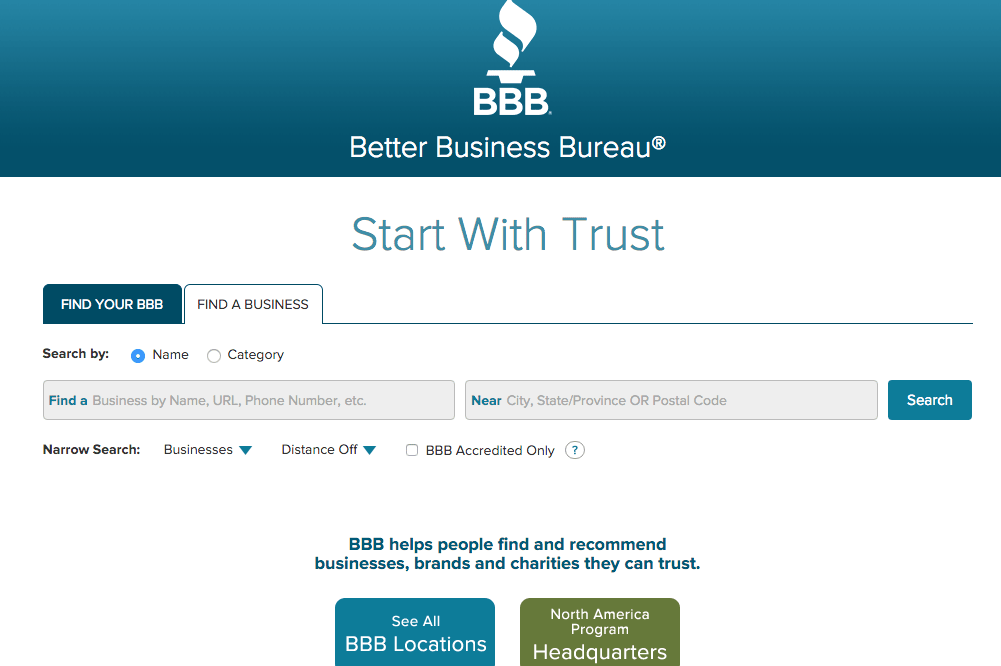

Step 3: Research the lender. Check out a few of the companies with the Better Business Bureau.

- Notice if any complaints have been made and if they were resolved. Find out what rating the BBB gives the lenders.

Step 4: Talk to an officer. In addition to looking online, talk to the loan officer at your local bank or credit union to see if you can get approved for an auto loan. Some banks and credit unions might offer special rates for members.

Part 3 of 4: Finance through a dealer

If you can’t get approved for a loan on your own, talk to the dealership. Most provide in-house financing through a group of lenders and provide approvals for almost all credit levels.

Step 1: Figure out your down payment. Provide as much of a down payment as you can to increase your chances of approval. Subsequently, a higher down payment decreases your monthly payments and reduce the amount you end up paying over the lifetime of the loan.

- Warning: Check with your insurance agent before buying and make sure you are happy with the amount of your new insurance payment. You don't need the added surprise of an unexpected increase in your monthly insurance payment on top of your vehicle payment.

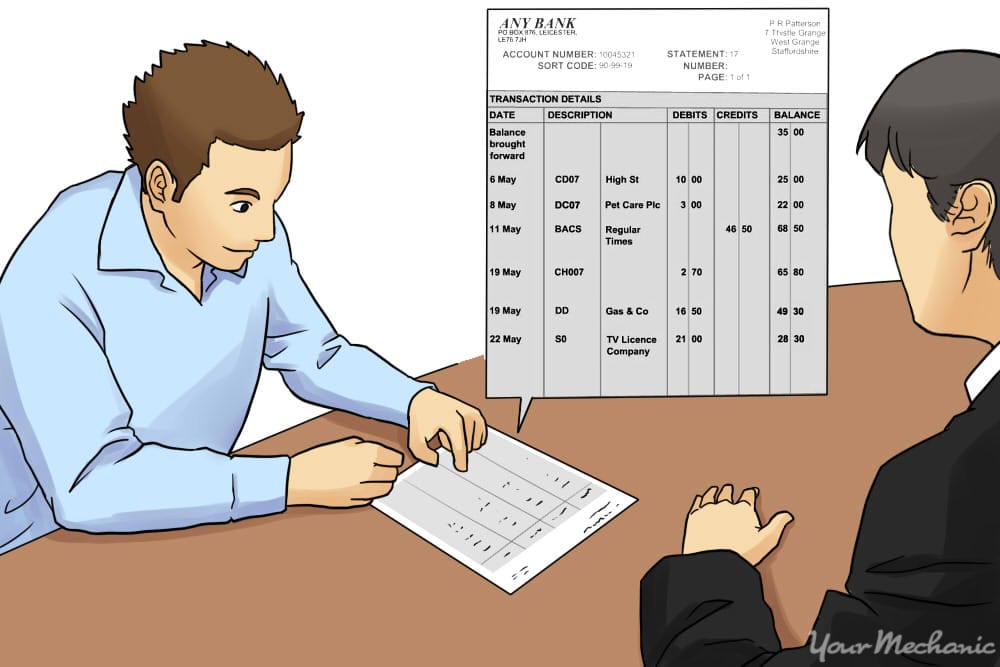

Step 2: Provide your paperwork. Bring your last two paystubs and previous two months of bank statements with you to the dealership.

To provide proof of residency, you can bring a recent utility bill, a list of references of friends, family, and business associates not living in the same household as you.

Tip: Find out how much you’re approved for before you start looking at vehicles. This way, you’ll know what you have to work with. In addition, getting pre-approved can save you the time of looking at vehicles you cannot afford.

Part 4 of 4: Set up a loan through family or friends

If you absolutely cannot find another financing option, you can ask your family or a good friend to loan you the money, or at least have them co-sign for you if they are willing. You may have to select a less expensive model, but you can pay it off sooner.

Step 1: Know what car you want. Have a vehicle in mind or at least a dollar amount before you talk to your family.

- Note: Remember any taxes or other fees you have to pay, and make sure to include them in the loan amount.

Step 2: Explain why you need a loan. When you ask for the loan, explain why you need it and how you can pay it back.

- If needed, sign a contract. That way everything is spelled out for both parties. Make sure that everyone has a copy of the contract as well.

Step 3: Have a detailed contract. The contract should have details about the monthly payment amount and due date, along with interest rate and length of loan, just as you would have with a traditional lender.

- Tip: Make sure the payment is something you can realistically afford.

Step 4: Get a co-signer if necessary. As another option, you can also ask your family member if they will co-sign on a loan with you.

- Tip: Make sure the co-signer has good credit. Otherwise, they won't qualify as a co-signer. This helps improve your credit, so you can get a car loan on your own next time.

Getting a car financed does not have to be hard. By comparing lender rates and terms, and by making sure your credit score is good, you can be riding in a pre-owned vehicle in no time. Before buying a pre-owned car, make sure to have one of our expert mechanics perform a pre-purchase car inspection to make sure everything works properly.