When you buy a car but don’t have funds for the full purchase price, you can arrange a loan through a bank or lender. You make payments on an amount owed according to an agreed-upon sales contract.

The loan agreement contains many terms and conditions for the sale including:

- The length of the loan term

- The amount of your payments

- The schedule of payments (weekly, bi-weekly, or monthly)

There are several situations that can occur where you may want to disburse your car loan or have someone else take over your car payments. These situations include:

- No longer being able to afford your car payment

- Wanting a different vehicle

- Moving to a location where you don’t need a vehicle

- Being unable to drive for medical reasons

Whatever your reason may be for wanting to get rid of your car loan payment, there are several ways you can approach the situation.

Method 1 of 3: Pay off the loan

This may sound like an oversimplified solution, however, many people with a loan are unaware of many details. Buying a car is overwhelming and it is quite possible that details are forgotten or not explained fully in the excitement of your car purchase.

Step 1: Contact your lender. Determine how much money is still owed for the car loan.

Most loans for car purchases are open loans and can be paid off at any time.

If you have the money to pay off your car, whether from a bonus at work or an inheritance, you can usually contact your lender and arrange to fully pay the remainder of your loan.

Step 2: Pay off the loan. When you have the amount of money ready, set up an appointment with the lender and pay off the car.

Paying off your car loan early saves you interest on the financed amount. It also frees up your income, which is beneficial if you are applying for credit.

Your debt to service ratio is significantly lowered, making you look better to the potential lender.

Method 2 of 3: Find a buyer

Car loans are based on a purchaser’s credit score and their ability to repay the loan. Lenders will not transfer a car loan to another person without determining their eligibility to obtain financing.

The bank will need to:

- Verify the purchaser’s identity

- Run a credit check

- Verify the purchaser’s income

- Complete a loan contract with the buyer

- Remove the lien from your vehicle’s title.

What you will need to do is:

Step 1: Determine the outstanding balance on your car loan. Call your lender and ask for the current loan payoff amount. This is the amount of money left that you still need to pay.

- Tip: If you owe more than you expect to get from your car’s sale, you can add in funds from your own bank account, once you sell your car, to pay off the loan in full. Owing more on your car loan than your vehicle’s value is known as “negative equity”.

Step 2: Advertise your car for sale. You will need to put your car up for sale by placing advertisements targeting potential buyers.

- Tip: You can use online websites such as Craigslist, AutoTrader, print ads in the local paper’s classified section, or print flyers for posters on community bulletin boards.

Step 3: Negotiate a purchase price with the potential buyer. Remember that you need to receive a certain amount to pay off your loan.

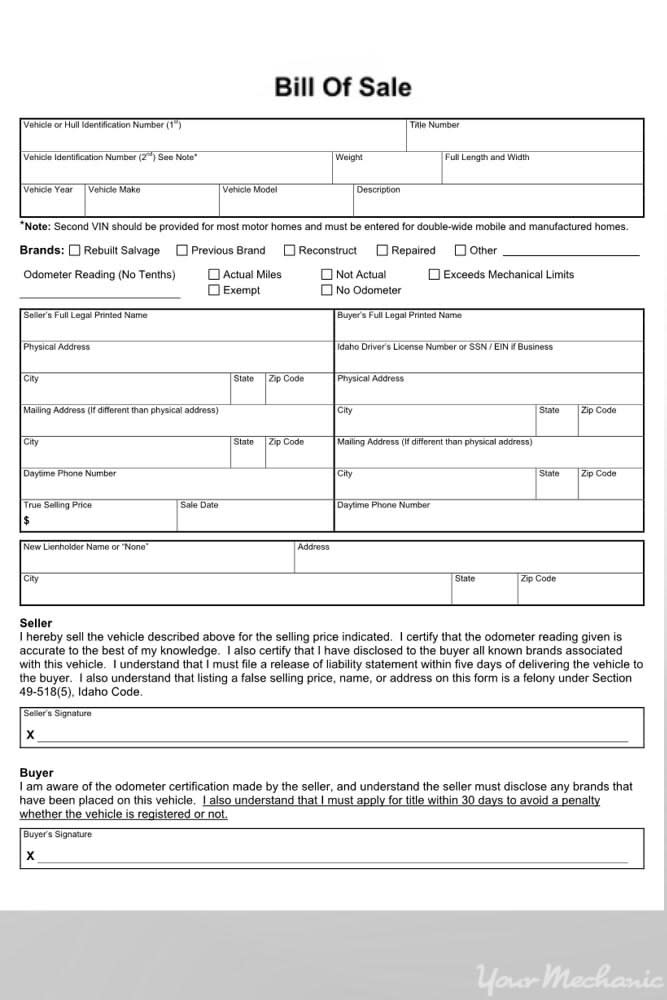

Step 4: Fill out a bill of sale. Fill out a bill of sale with the purchaser for the agreed-upon sale price.

- Note: Make sure the bill of sale contains both party’s contact information, the vehicle’s description, and the VIN number of the car.

Step 5: Contact your lender. Inform them you are selling your vehicle and need to make arrangements to release the lien on you car.

Liens are the rights to the vehicle owned by the lender when payments are still being made towards a loan.

The loans officer will verify the details of the sale and release the lien when a Bill of Sale is made.

Step 6: Collect the full payment from the purchaser. If the purchaser is going to be making payments on your vehicle, they will need to obtain financing from a lending facility.

Once they’ve received the loan, they will be obligated to make payments on that loan instead of you.

Their car payment can vary greatly compared to your payment depending on many criteria, including:

- The length of term they chose

- The interest rate they obtained from their lender

- The amount of their down payment

Step 7: Pay off your loan. Bring the full payment for your loan to your own lender who will then dissolve the loan if it was paid in full.

After the loan is paid in full, you will no longer have to make car payments!

Method 3 of 3: Trade in your car

If you have enough equity in your car, you can trade it in for a vehicle of lesser value and walk away without a payment.

Step 1: Determine your car’s buyout amount. Contact your lender and request the total buyout amount along with the disbursement fees.

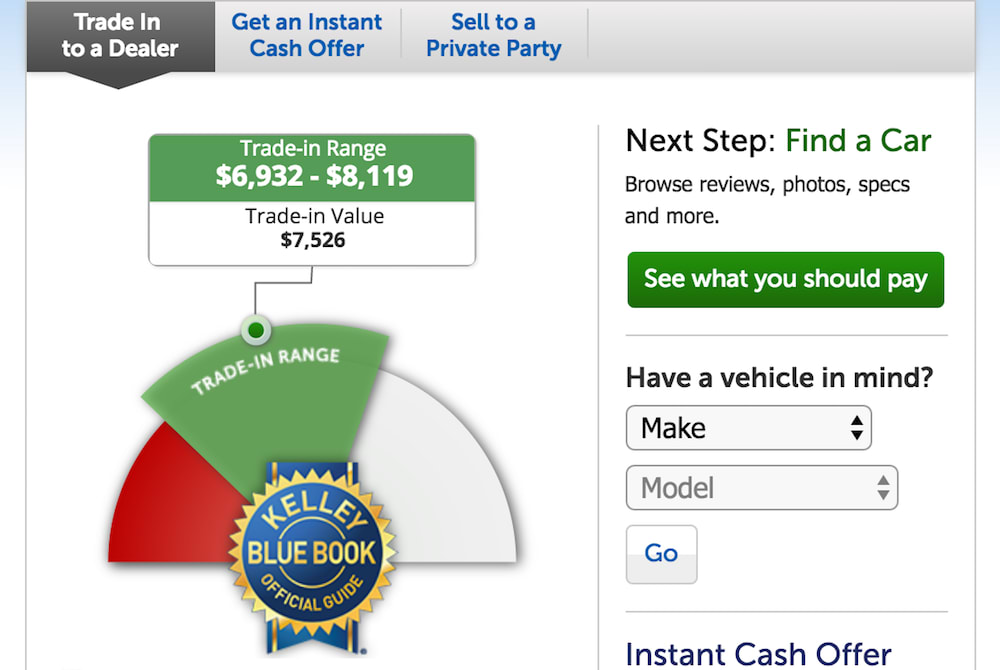

Step 2: Find your car’s trade-in value. Check your car’s approximate trade-in value on Kelley Blue Book’s website.

Enter your vehicle details exactly with the correct options and exact mileage. The website will generate an approximate value based on the model, year, mileage, and condition of the vehicle.

Print the results and take them with you when you go to the car dealership.

Step 3: Speak to a salesperson or manager. Clearly express your intent to trade-in your vehicle to the dealership and obtain a loan-free vehicle.

Step 4: Have your vehicle appraised by the sales manager. When you bring in your car to the dealership where you want to trade your car, a sales manager will give your car an appraisal for its value.

- Tip: At this point, you should try to negotiate the best value for your car. You should use your Kelley Blue Book printout to support your position for the car’s worth.

The difference between your vehicle’s appraised value and the total loan buyout amount is the equity you have to spend on a different vehicle.

For example, if your loan payoff amount is $5,000, and your vehicle is appraised at $14,000, you can look for a vehicle worth $9,000 including taxes and fees.

Step 5: Select a vehicle. Choose a vehicle that you would like to trade for.

Your options will probably be limited, and you may need to select a vehicle that’s a few years older or has higher mileage.

Step 6: Complete the paperwork. Complete the paperwork with the salesperson to make the sale of your car official.

In your sales agreement, the dealership will pay off your loan and take your car on trade, and you will receive your new car without a loan.

By following any of the methods above, you will be able to absolve your responsibility from making any more loan payments for your car. If you want to make sure that your car is at its highest value at the time of a sale or trade, you can have your vehicle inspected by a certified mechanic from YourMechanic. They can visit your location to ensure that all of the maintenance for your car is complete and that the car is running smoothly for its new owner in a sale or trade.