It’s not the ideal situation, but you may find yourself in need of immediate car financing. It could be because:

- You found your dream car

- Your car broke down and needs to be replaced right away

- You’ve had to sell your car to repay a debt

- You’ve just began a job that isn’t accessible by public transportation

Buying a car is stressful enough on its own but when you are under a time constraint, it is even more difficult. Getting car financing, or an auto loan, can sometimes take days or even longer to be approved for the type of vehicle you want, and sometimes you just can’t wait that long.

Many credit providers, used car dealers, and even some franchised car dealers offer same day car loans to buyers. If you have good credit, your options are much better. If your credit isn’t as good as it could be, you may be limited but you can usually still obtain a same day car loan.

Method 1 of 2: Get a same day car loan if you have good credit

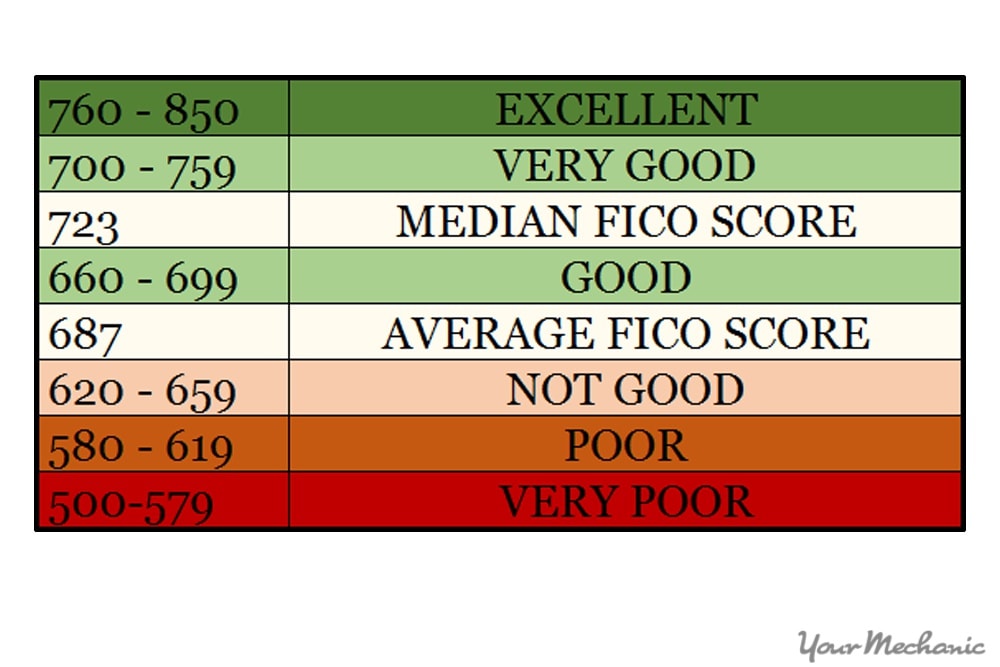

Before deciding which Method applies to you, it’s necessary to know your credit score. Even if you’re in a rush to get to the dealership, it’s wise to take a few minutes to find out your credit score before you leave home. You can get it quickly online from sites such as Credit Karma.

If you have good credit, you’re a desirable client for lenders, whether it’s through a bank, a car dealer, or another auto lender. You’ll be able to get same day car financing without any trouble as long as you have income to support the loan.

Materials Needed

- Personal identification (usually photo ID and one other form of identification)

- Proof of income

Step 1: Find competitive offers from lenders. You are in control as you are an excellent potential client. Don’t be afraid to let the lenders know you are looking around for the best deal for financing.

Collect 5-7 appealing promotions or offers from lenders, noting which ones have the best repayment rates and any perks for using their services. Narrow your list to the top three and rank them.

Contact the top three lenders and pit their offers against each other to get your best loan terms.

Step 2: Fill out a credit application. Give as much information as you can to support your application.

Be accurate and truthful as false information can result in your application being denied and a flag on your credit bureau.

Step 3: Provide identification. Provide a copy of your identification, usually a driver’s license and another piece of ID like a credit card, birth certificate, or passport.

You aren’t obligated to provide your Social Security Number, though putting it on your application can mean your application processes faster.

Avoid filling out multiple credit applications if possible. Multiply hits on your credit bureau can raise flags similar to potential identity theft, restricting your credit or dropping your credit score.

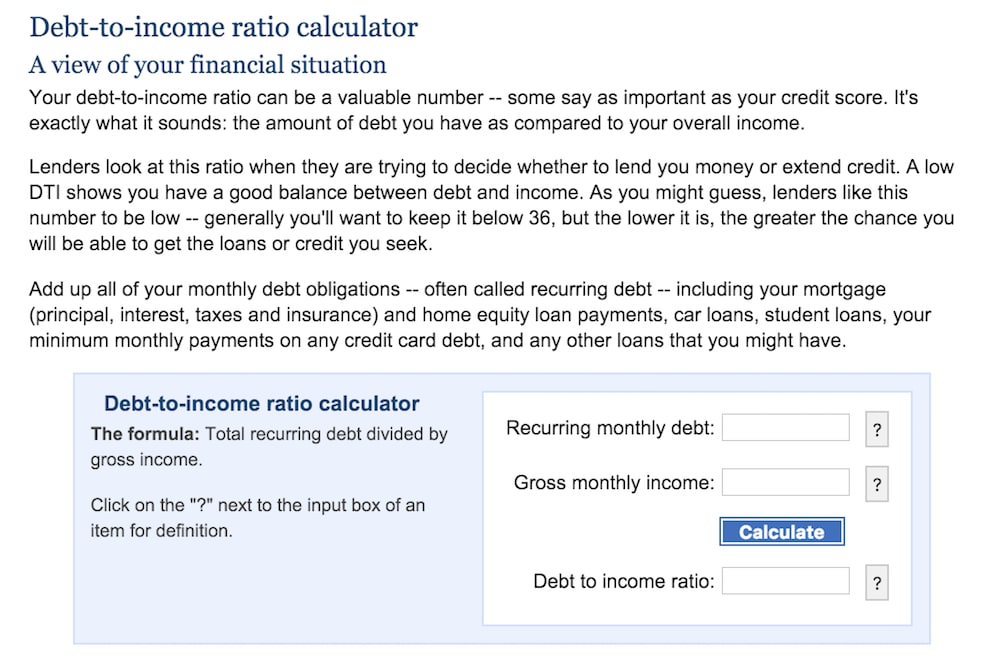

Once you’ve filled out a credit application, you’ll quickly receive an approval if your credit history is good and you’re able to make the payments according to your debt-to-service ratio (DSCR), also known as “debt-covering ratio,” meaning the ratio of cash you have available to pay debts.

For example, if you pay $1500 a month for your mortgage, $100 a month for a car loan, and $400 a month for the rest of your debts, your monthly debt payments are $2000. If your gross monthly income is $6000, then your debt-to-income ratio is 33%.

Step 4: Complete the car loan. Read the terms of your loan agreement closely. If they are not the same as what you’ve been promised, don’t sign the contract.

If the lender won’t honor the promised rate or terms, go elsewhere and complete a new application.

Method 2 of 2: Get a same day car loan if you have bad credit

Materials Needed

- Banking information

- Down payment

- Personal identification (photo ID and one other form of identification)

- Proof of income

If your credit is less than desirable, it can be just as easy to get a same day car loan but your repayment terms will be different. If you have poor credit or no credit, lenders view you as a higher risk to default on your car payment. Essentially, you haven’t proven yourself to be worthy of a low interest rate and competitive repayment options.

A same day car loan can be your first step to building or rebuilding your credit score as long as the lender reports your loan to the credit bureaus. Typically, same day car loan lenders don’t require a credit check but will still require verification of your identity.

Same day car loans are usually provided by the dealer or lender out of their own pocket, acting as their own bank. You can expect that your interest rate will be high and you repayment term length will be shorter than someone who has good credit. This is a way for the lender to recoup some of their high-risk loan quickly in case you default.

Step 1: Shop yourself around to lenders. Look for reputable dealers or lenders who have recognizable and established businesses. Look for the best rates possible for bad or no credit situations.

Talk with the lenders to “test the waters.” Get a feel for whether they think you will get financing.

Step 2: Know the terms you are going to be receiving. Your interest rate will be much higher than the low advertised rate they have.

Your payment will likely stretch what you are comfortable with paying monthly.

Step 3: Complete an application. Fill out an application form completely and honestly. Your personal information and income are likely going to be verified before you are given credit.

Let the lender know if you are willing to have your payments automatically debited from your bank account, and give them your banking information to show you are serious.

If you are willing to have the money withdrawn automatically, it helps reduce the risk of defaulting on your car loan payments. You may even get a better interest rate because you are helping reduce your risk.

Inform the lender if you have a down payment. It will assist you will getting credit if you have a down payment for your car.

Provide your identification and proof of income.

Step 4: Take out the car loan. If the terms are agreeable to you and you are able to repay the amount required, sign up for the loan. Confirm the terms of the agreement before you sign the paperwork.

If the terms are different than you were told, don’t sign the paperwork until it has been cleared up.

You have the option to go to another lender, so don’t agree to something because you feel you have no other choice.

If you need same day financing for a car you want to buy, it’s a good idea to walk into the dealership as prepared as you can be. Find out your credit score before you leave home so you know which approach to take when you arrive. If you have good credit you’re in a better position than if it’s bad but never hesitate from walking away from a deal that doesn’t feel right.