A person’s financial situation can change while they are paying off a car loan, and if it changes for the worse, then it will be difficult to make the payments on time each month. This happens to many car owners, and the usual course of action is either to sell the car in order to pay off the loan, or refinance to adjust the terms of the loan, making the payments more manageable. These are not, however, options available to everyone.

If the value of your car is less than the amount of money owed, then you are upside-down on the loan, and selling the car will not erase the debt. Similarly, if you do not have a good credit score, then you may not be able to refinance the loan. In this case, the only course of action is a loan modification.

Part 1 of 1: Acquire the loan modification

Step 1: Consider your situation. Figure out if a loan modification is the right thing for your situation. If it is at all avoidable, then attempt to remedy the issue without a modification, which is a change in the terms of the loan agreement, resulting in a more affordable rate.

Step 2: Remember the facts.You do still need to keep some things in check while making the decision, since you need to be approved by the lender to receive a loan modification. Remember, a loan modification is not a refinance, but rather simply a reduction of payments, so that you can keep making them regularly under financial stress.

- Note: You must keep paying the loan while applying for the loan modification. Even if you cannot make the payments in full, pay what you can and document everything, so you can present the information as evidence later on.

Step 3: Gather paperwork. Prepare to apply for a loan modification by gathering the necessary paperwork and doing the math on the exact details of your financial situation. Here are a few types of material to keep in mind:

Proof showing that you have paid as much as you can afford of the loan so far

Proof of a change of income, such as pay stubs or other relevant documents

Proof of extra expenses, such as medical bills, divorce, or other sudden expenses

Proof of hardship or of a negative turn of events in your life, which can boost your chances of being approved

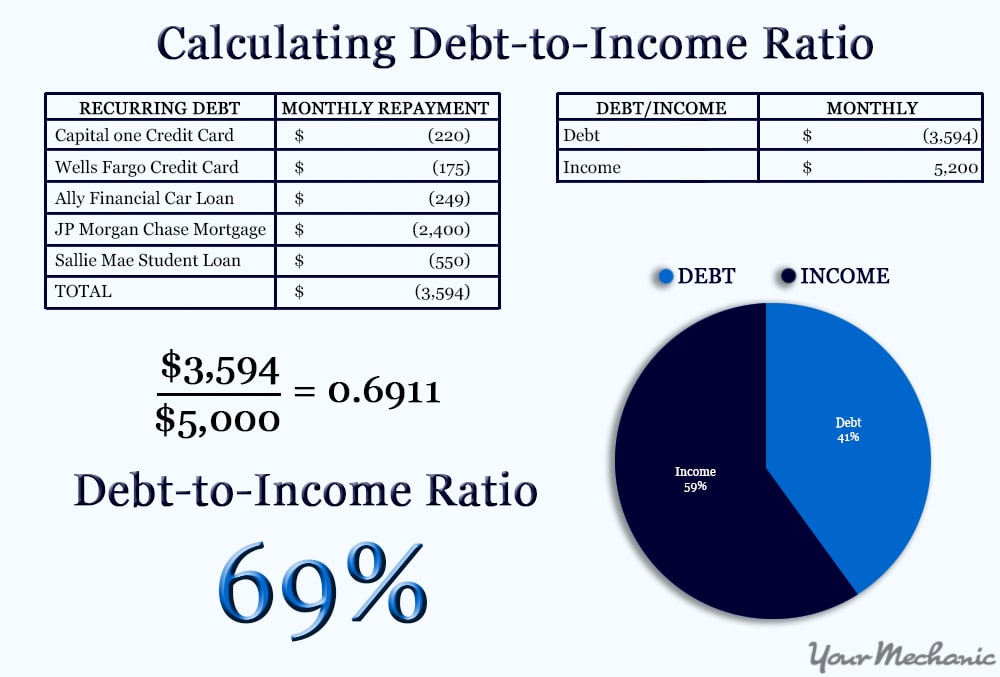

Step 4: Determine your debt-to-income ratio. Calculate the total amount of money you pay per month towards debt compared to the amount of income you earn in a month. This is called the debt-to-income ratio and is crucial to revealing the amount you can afford to pay of the loan.

Step 5: Determine your new payment amount. Calculate the exact amount to which you want the loan payment reduced .

- Tip: If you can submit this figure, along with the math used in determining it, the likeliness of both the adjustment getting approved and the terms being agreeable is increased.

Step 6: Apply for the modification. Apply for a loan modification with the lender that handles your car loan. When dealing with the lender, bear in mind that a loan modification is not something that the lender wants to do, but something which is done in order to avoid the costly process of repossessing the car.

Depending on the type of bank you are dealing with, here is some advice to keep in mind:

If you go through a local lender, meet with them in person to discuss your options and decide if a loan modification is right for your situation.

If your lender is not local, then see if they have a help number specifically for loan adjustment and refinancing. This, if available, will lead you straight to employees that are looking to get you out of this situation while ensuring the lender gets paid.

If the lender has no other means of contact, simply call and speak to someone who can help you adjust the payments of the loan or, at least, discuss your options. Some lenders do not have loan modification as an option.

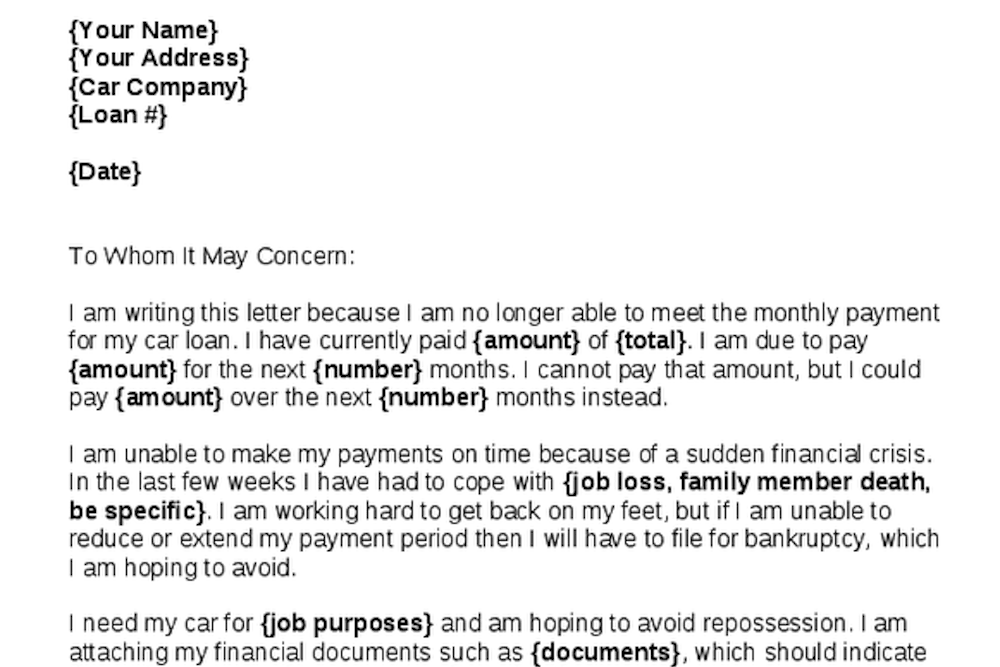

Step 7: File the paperwork. After you get the go-ahead from your lender to do a loan modification, then you have to formally file the paperwork and send a “request for assistance,” also called a hardship letter, to the lender.

This is the most important step, as this is the part where you show all of the information you have gathered as evidence of your situation.

You should make sure to:

Show that you made the payments as agreed until you hit financial distress.

Show that you attempted to make payments after that point to the best of your abilities.

Request that your loan payment be reduced to the figure you calculated earlier. If you provide all of the evidence and show all of the math involved, you are much more likely to be approved for a modification.

Step 8: Respond to the lender: You will receive a reply from the lender in response to your request for assistance. Your response will depend on their offer:

If they refuse a modification, you may have to hand the car back and take the hit to your credit score or sell the car,taking on the remainder of the loan as additional debt.

If they agree to a modification but their terms will simply not work for your situation, make this clear and submit more proof backing up your claim.

If they agree to terms that will work in your current financial situation, then you can accept the loan modification. Be financially responsible and put as much money towards the loan as you can as soon as your situation improves.

Needing a loan modification is never an ideal situation in which to find yourself, but sometimes your circumstances require it. Perhaps you have had to take on necessary debt, and your finances will not allow you to continue payments as scheduled. Whatever the case may be, fortunately, loan modification is a process that allows you to preserve your credit from the serious hit of a repossession, at the same time as you can, hopefully, receive a new and more affordable payment rate and thus acquire sounder financial footing.