When tax time descends the first quarter of each year, people scramble en masse to find any credits, deductions, or exemptions for which they qualify. Taking advantage of any tax breaks available can greatly reduce the amount of taxes paid.

In some cases, there are even breaks for being environmentally friendly. This means that owners of hybrid vehicles may be eligible to claim certain perks on their federal and state tax forms.

Part 1 of 2: Check the requirements for tax breaks on hybrid vehicles

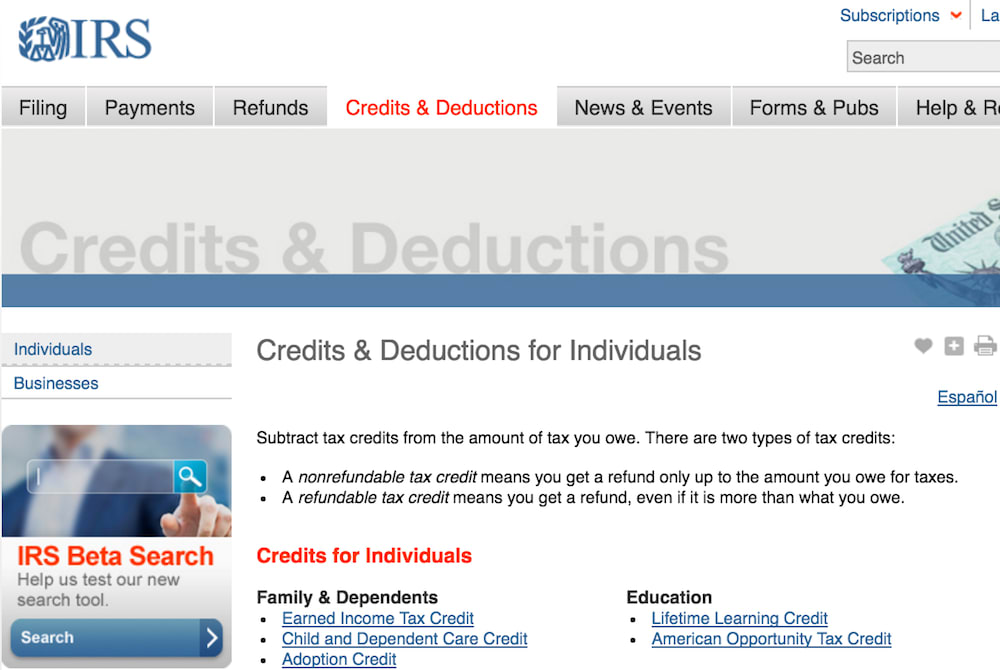

Step 1: Visit the IRS website for the most current information on tax credits. The Credits & Deductions page has a section devoted to Electric Vehicle Credit.

Step 2: Read each of the four sections that relate to credits for electric or hybrid vehicles. These sections are Plug-In Electric Drive Motor Vehicle Credit, Plug-in Conversion Credit (Section 30B(i)), Alternative Fuel Vehicle Refueling Property Credit (Section 30C), and New Qualified Fuel Cell Motor Credit (Section 30B(b)).

As a general rule, you must have purchased a gas-electric hybrid prior to 2010 to claim a purchase credit, or have converted your car to a hybrid before 2012 to claim a plug-in conversion credit. Other credits include the price of the electricity or alternative fuel used to power your vehicle in the tax year, and the purchase of a plug-in hybrid.

Step 3: Take note of the federal tax credits and deductions that apply to your hybrid vehicle. Most tax breaks do not apply to hybrids that were purchased used.

The rules also vary according to the car manufacturer and specific model. Many of the federal credits and deductions for hybrid vehicles have been phased out.

Step 4: Determine whether you can claim any credits, exemptions, or rebates at the state level. While the types of tax breaks you can get from owning a hybrid vehicle are fast dwindling at the federal level, there are a few states that offer incentives to hybrid owners. The National Conference of State Legislators website has up-to-date information on which states offer what incentives.

Part 2 of 2: File the required tax forms

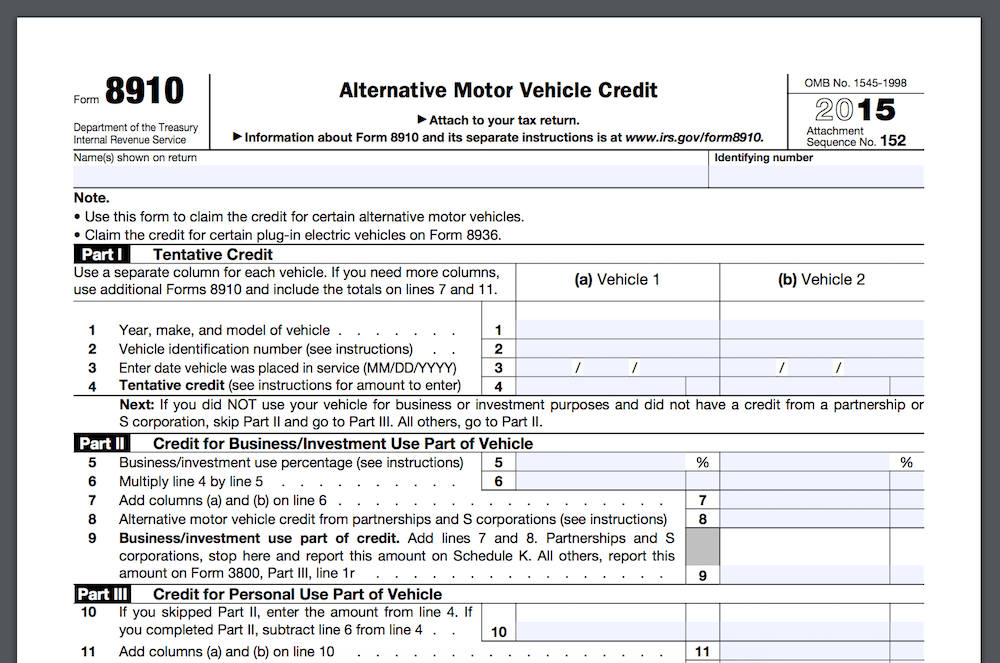

Step 1: Print out the appropriate federal or state tax forms to claim credits. You can find the required federal forms on the Plug-In Electric Drive Vehicle Credit at a Glance page of the IRS website.

To access state forms, visit your local IRS office’s website to download or request the appropriate paperwork. Links to contact specific websites are on the Contact Your Local IRS Office page of the IRS website.

Step 2: Fill out the tax forms you print. Provide the forms to your tax preparation agency or accountant, or include them with taxed you prepare yourself.

The IRS will review them for accuracy and later apprise you of whether the credit, exemption, or other tax break is accepted.

Bear in mind that the tax credits for hybrid gas-electric vehicles are largely defunct since the end of December 2010. However, if you have purchased a plug-in hybrid, there are still many credits available to you. The amount of such credits vary largely according to the size of the battery, with larger battery sizes netting higher credits. With any luck, if you follow the steps above, you may be able to find some additional funds in your tax return next tax season.