Setbacks in life are inevitable, but how you deal with challenges like a lost job or sudden costly repair are how you establish your character. Whether it is a one-time occurrence or potentially a long-term issue, if you find yourself in a situation where you are unable to make your monthly car payment, there are actions you can take to minimize the consequences. This can include the loss of your car and a significant drop in your credit score.

Method 1 of 4: Contact your lien holder

Step 1: Get in touch with your lien holder. While your first instinct may be to avoid the issue and pretend it doesn’t exist, this does nothing to help your situation.

Call or visit your lien holder - the individual, car lot, or banking institution that financed your car.

Step 2: Let them know you will not be able to make your payment. Tell the lien holder you will not be able to make your payment and why.

Also, include an idea of when or if you expect your financial situation to improve. The person handling your loan will appreciate your honesty and be more inclined to make arrangements with you when you take an honest approach.

Step 3: Request an extension. Ask if you can have an extension on your monthly payment or refinancing to reduce the payment to something you can afford.

The lien holder may prefer to work with you now so that both parties can eventually complete the sale.

Method 2 of 4: Refinance your car loan

If your credit is good or your interest rates have recently declined, refinancing your loan is a possible way to get your monthly payment lowered. As with refinancing a home loan, this method will only work if you have enough equity in your current car loan.

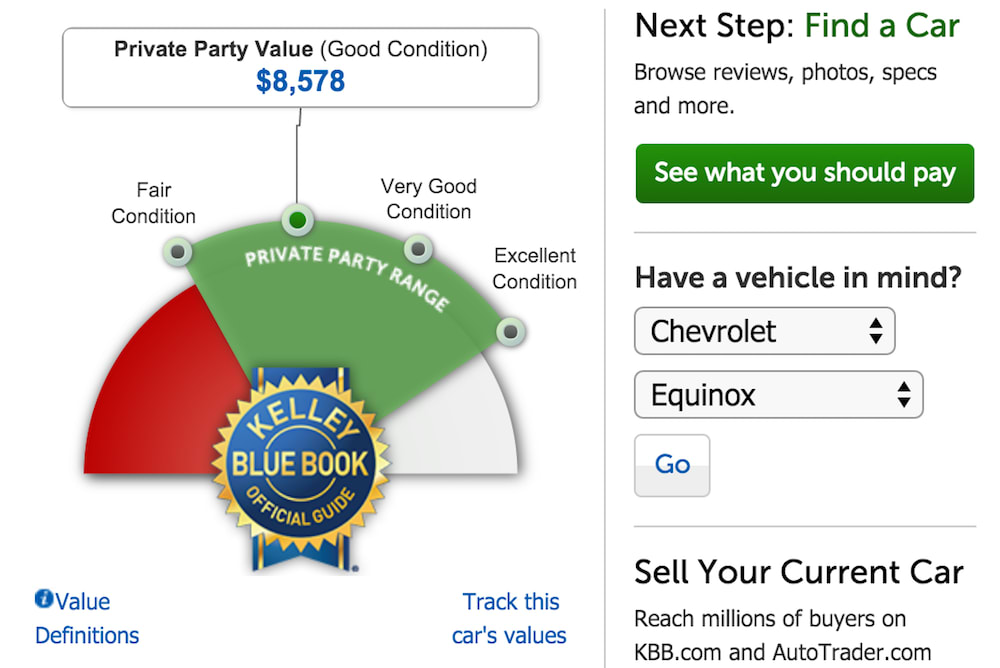

Step 1: Find the current value of your car. The first thing you will need to do is obtain the current value of your car.

Websites like Kelly Blue Book or NADA are ideal for this purpose and are free of charge while being easy to navigate.

Step 2: Find out how much you owe on the car. Check how much you still owe on your car. The balance remaining should be on your prior payment receipts, but you can also call the lien holder to obtain this amount.

Step 3: Determine whether refinancing the car is feasible. If the balance of your loan is less than the current value of your car, refinancing your car is an option worth exploring. In the case that you owe more on your car than it is worth, you will most likely need to try another method for handling late car payments.

Step 4: Seek out other lenders. Compare interest rates from various lenders, and apply for a refinancing loan through the lenders with the best interest rates.

- Tip: Bear in mind that, each time your credit report is accessed by a potential lender, it negatively affects your credit score. Limit your credit inquiries by only approaching lenders with the best chance of success, such as your banking institution or another lender with which you have an established history.

Method 3 of 4: Sell your car

While not the most attractive option, you can get out of your loan repayments by selling your car. Advertising in print and online classifieds is a great way to get the word out about your vehicle for sale. Once you find a buyer, use their money to pay off your loan and then transfer the title to the new owner.

- Tip: This method will only work if you can sell your vehicle for more than what you owe on it. For the best idea of what you can get for your car, check your local classified ads to see the asking price on cars that are similar to yours. This will be a more realistic price than the estimated value of your car that you can find on websites like Kelley Blue Book and NADA.

Step 1: Determine a price for selling your car. Similar to Step 1 in Part 1, find out the current worth of your vehicle from websites such as Kelly Blue Book or NADA.

Keep in mind, that in order to quickly make this sale, you may have to sell the car at a much lower price than usual.

If you’re fortunate, there may be enough money left over for you to purchase another cheaper car, or one with payments low enough for you to afford in your current financial situation.

Step 2: Advertise your car. You should now choose a medium for listing your car. Common places to advertise your car are Craigslist and AutoTrader.

You may even want to tell family and friends that you are selling the car at a good price. It may be the most convenient to deal with someone that you already know.

Step 3: Sell the car and transfer the title. Meet with potential buyers and show them the car. If they like what they see, draft a bill of sale and complete a title transfer after the payment has been made.

Method 4 of 4: Voluntarily surrender your car

Once you have checked into other options without success, your only recourse may be to voluntarily surrender your car, or allow the lienholder to repossess it without any fuss.

Although this will be reflected on your credit as a standard or involuntary repossession, you will not owe your lender for expenses associated with them physically taking your car back. The lien holder will likely then sell the car at auction. You will be responsible for any difference between what you owe on the car and the amount it sells for to the highest bidder, but that amount won’t incur any interest.

Step 1: Get in touch with your lienholder. If none of the methods above were successful, you can simply have the car repossessed by the lienholder.

At this point you will need to make an appointment to relinquish the vehicle and sign any paperwork.

Regardless of the outcome of any of the above methods, it is better to face the issue of being unable to make car payments as soon as possible. The longer you wait, the less inclined your lien holder and other institutions will be to help and the more your potential array of solutions shrink. Taking care of the problem now will also save you stress and hassle down the road.