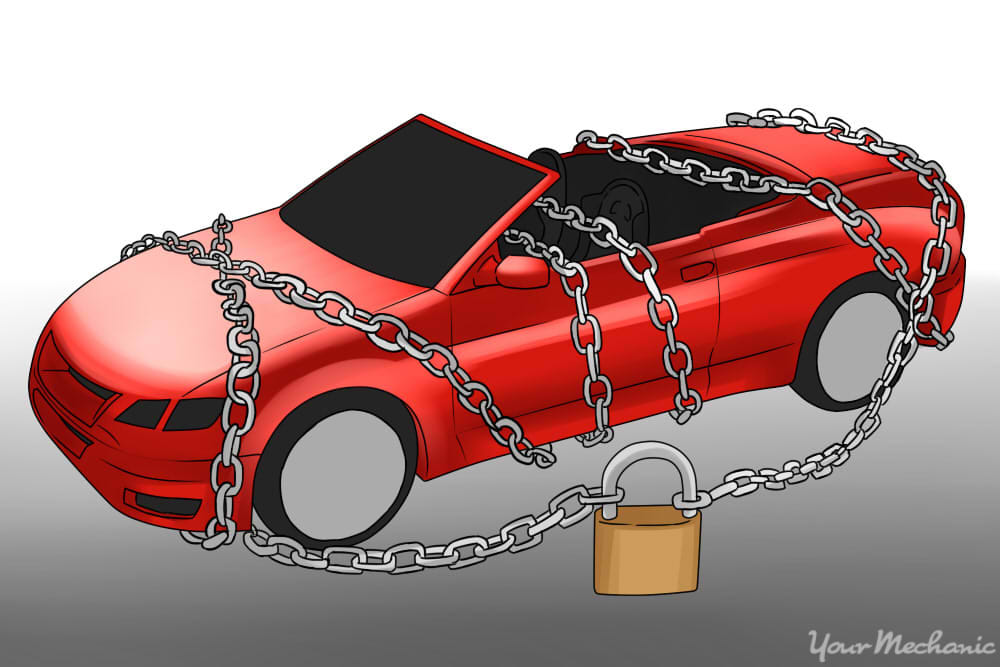

If you are trying to buy a vehicle and find out that there is a current lien on it, the process becomes more complicated. With a lien on the title, you may not be able to:

- Transfer the title into your name.

- Register or insure the car.

- Obtain a loan for the car purchase.

An auto lien gives the leinholder the legal right to take possession of a car while a debt is owed on it until the loan is paid in full and discharged. When a lien is in place on a car title, that typically means that there is an outstanding loan on the vehicle. A lender will not be able to place their own lien on the car as collateral for the loan if a lien is in place.

Also, if you purchase a vehicle outright without a loan and there is an outstanding lien in place, there is a possibility of the vehicle being repossessed from you through no fault of your own. Rather, it could be repossessed if the seller doesn’t fulfill the duties of their loan.

Before completing a vehicle purchase, you need to make sure any existing liens are discharged.

Part 1 of 2: Find out if there is a lien on the car you wish to purchase.

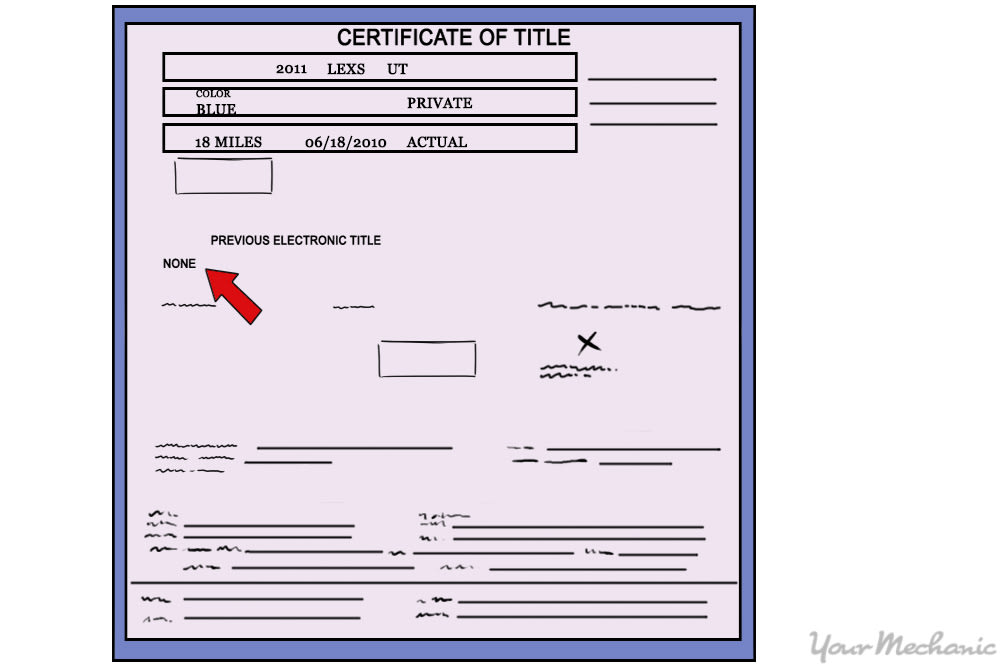

Step 1: Check the car’s current Certificate of Title. A lien against a vehicle will be listed on the title, declaring a third party’s interest in the vehicle.

Ask the seller to see the title. If they produce a photocopy, ask to see the original. Don’t trust a photocopy to be a true copy of the original.

If there isn’t a lienholder listed on the title, double-check with another method to confirm.

Step 2: Check for a lien with your lender. If you are obtaining a loan for the purchase of the car, call your loans officer with the VIN number of your potential purchase. They will check for liens against the car. There may be a small fee for this service which will likely be passed along to you.

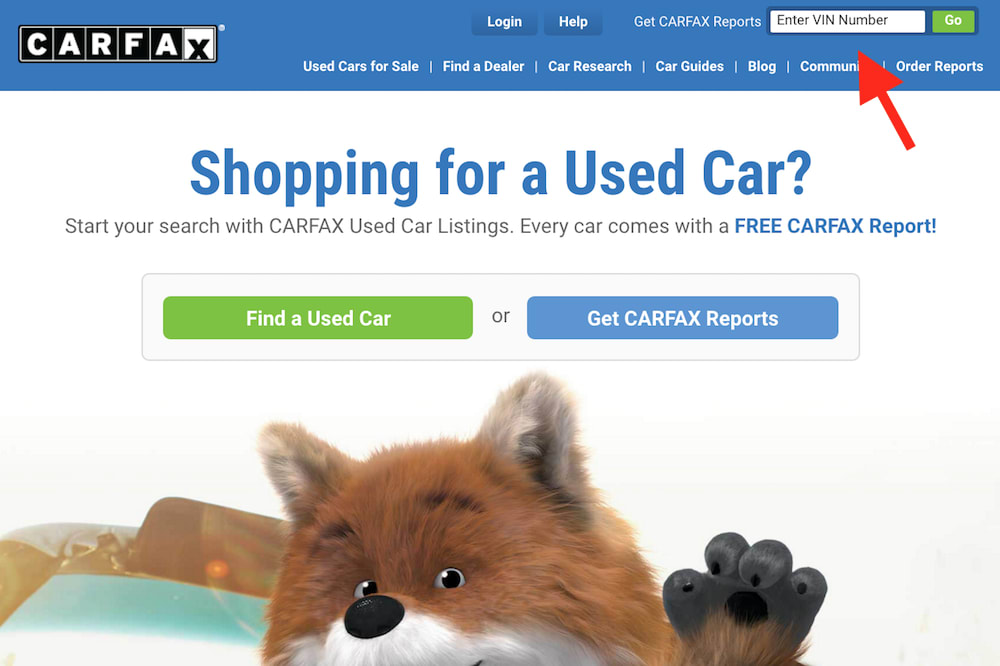

Step 3: Run an online vehicle history report, or VHR. A VHR can be run with just a VIN number through a number of online websites such as Carfax, MotoSnoop, and CarProof. Some services are free while others are a paid service.

If you are serious about purchasing the vehicle, a VHR is a great investment to make sure the car doesn’t have any sketchy history, title problems, or warranty blocks.

Step 4: Run a lien search with the state DMV the vehicle is titled in. Go online to the state’s DMV website and find their lien search, a free tool any offer such as Wisconsin’s DMV Lien Holder Search.

Enter the VIN number and a verification code to retrieve the results of the lien search.

Part 2 of 2: Purchasing a car with a lien

Step 1: Have the seller get the paid loan discharged. It may be possible that a lien has not been discharged although the loan is paid in full. The seller will need to contact their lender to receive a Confirmation of Ownership or a clear title without a lienholder listed on it.

- Note: Do not complete the purchase until the seller has the lien discharged.

Step 2: Have the seller re-finance the owed amount. If the seller has an amount owing on their loan, they can try to refinance that amount as a personal loan or on a line of credit that doesn’t carry the car as collateral.

The seller needs to have the loan discharged before you complete the sale, otherwise you will take on the liability for the outstanding lien.

Step 3: Re-negotiate the purchase with the seller. Make an agreement with the seller to pay the financial institution directly for the outstanding loan amount out of the previously negotiated purchase price. The seller would then receive the balance of the funds not owed to the bank.

If you try this method, do not pay the bank without a written agreement in place.

If the seller backs out of the deal after you have paid the loan, you are out that amount of money without a written agreement to bind both parties to the deal.

If the seller doesn’t agree to remove the lien on the vehicle, walk away from the sale. Buying a vehicle with an outstanding lien will almost definitely result in financial woes on your end that could leave you without the vehicle you purchased if it is repossessed or potentially thousands of dollars out of pocket covering someone else’s debts.