Bankruptcy does not have to mean the end of the world for you financially. Many individuals recover fully after a bankruptcy and even purchase a car soon after it is discharged. By keeping certain factors in mind when trying to purchase a car after a bankruptcy, you too can get a new vehicle.

Part 1 of 2: Types of bankruptcies

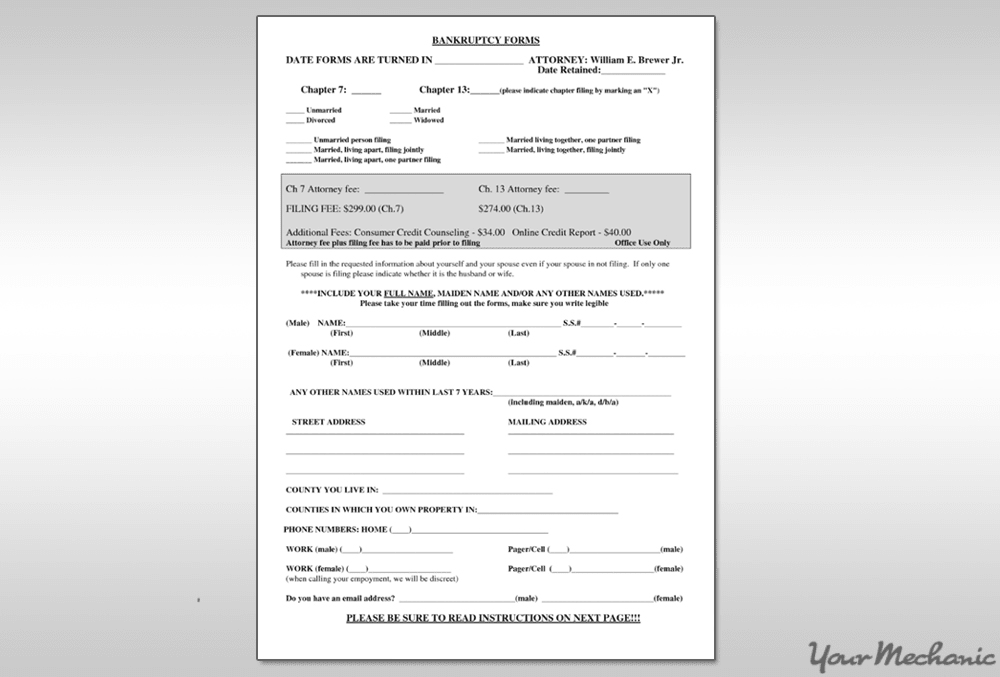

When it comes to bankruptcies, there are three types that you can file for as an individual: Chapter 7, Chapter 13, and Chapter 11, though a Chapter 11 bankruptcy is usually reserved for individuals whose debt falls above the limits of a Chapter 13 bankruptcy.

A Chapter 7 bankruptcy is for individuals who do not have the ability to repay their debt and is best suited for unsecured debt. It is the most common form of bankruptcy and allows debtors to protect some of their assets up to a certain amount.

A Chapter 13 bankruptcy, on the other hand, is designed to allow debtors to repay their debt over time. Supervised by the court, individuals who file for a Chapter 13 bankruptcy must get the court's permission before incurring any more debt, including buying a vehicle.

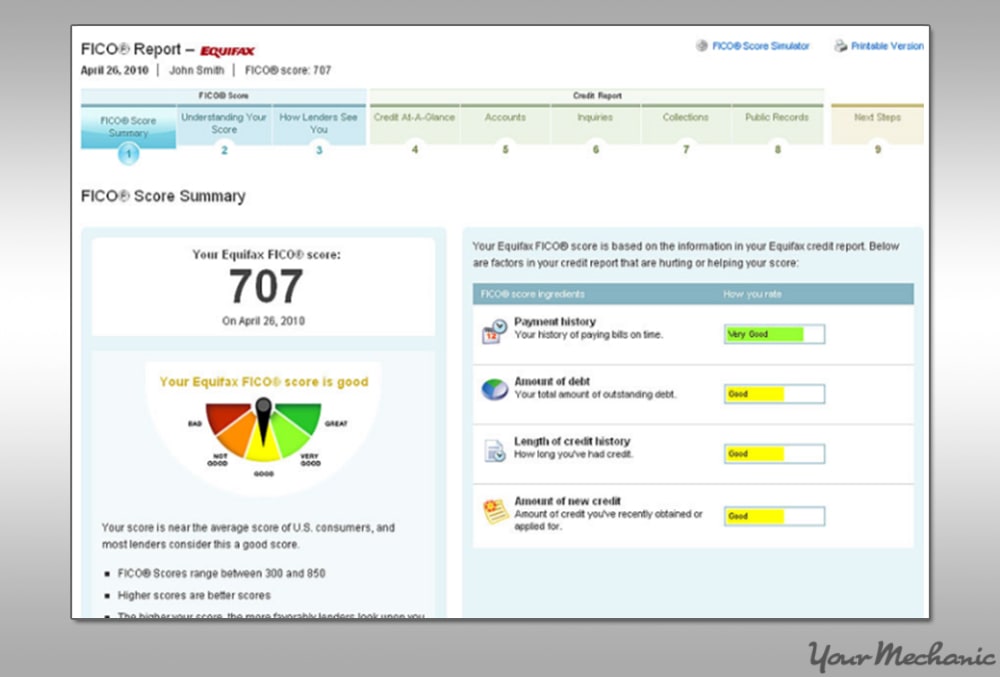

The best thing about bankruptcies is that they allow you to discharge certain debt, removing it from your obligation to pay it back. The downside is that a bankruptcy remains on your credit record for a number of years, lowering your credit score and making it more difficult for you to buy items, such as a vehicle, that are dependent on your credit score.

It is not impossible to buy a car after a bankruptcy, but expect to pay a higher interest rate, pay a larger down payment, or be restricted in the value of a car purchase depending on the bankruptcy type.

Part 2 of 2: Steps you can take to purchase a car after a bankruptcy

Rebuilding your credit after a bankruptcy is a long and arduous task. With it taking five years to pay off a Chapter 13 bankruptcy and another seven years for it to fall off your record after that, it seems like a long time before you can get back on track. A Chapter 7 is no better, taking at least 10 years to come off of your record. Luckily, you do have some options when buying a car following a bankruptcy.

Step 1: Get someone to cosign. Find someone to cosign for you when you buy a vehicle. The cosigner needs a good credit score, usually over 700, to qualify.

They also need proof of stable employment and residence. The longer the better, but most lenders prefer at least five years.

Remember to make your payments on time or the cosigner becomes liable for the loan amount.

Step 2: Rebuild your credit. By taking on a little debt and paying it off, you can improve your credit.

Apply for a credit card and use it for small purchases. Then make sure to pay the full balance on time every month. This can gradually push your credit score up.

Step 3: Make a larger down payment. Another option when buying a car after a bankruptcy is to pay more up front.

You can also use a trade-in to help reduce the amount you owe. Another possibility with a trade-in is selling it outright, and then using the cash from the transaction to help pay for your next vehicle.

- Tip: As you rebuild your credit following a bankruptcy, your credit rating should gradually improve, especially if you make all of your payments on time. Take advantage of your improving rating and refinance your car loan, which you can typically do every 6 to 12 months.

While a bankruptcy is damaging to your credit and can make it more difficult to acquire the things you need, such as a vehicle, you do have options. By making sure you pay what you owe on time, making a larger down payment when buying a car, or asking someone with good credit to cosign for you, you can still purchase a car even with a bankruptcy.