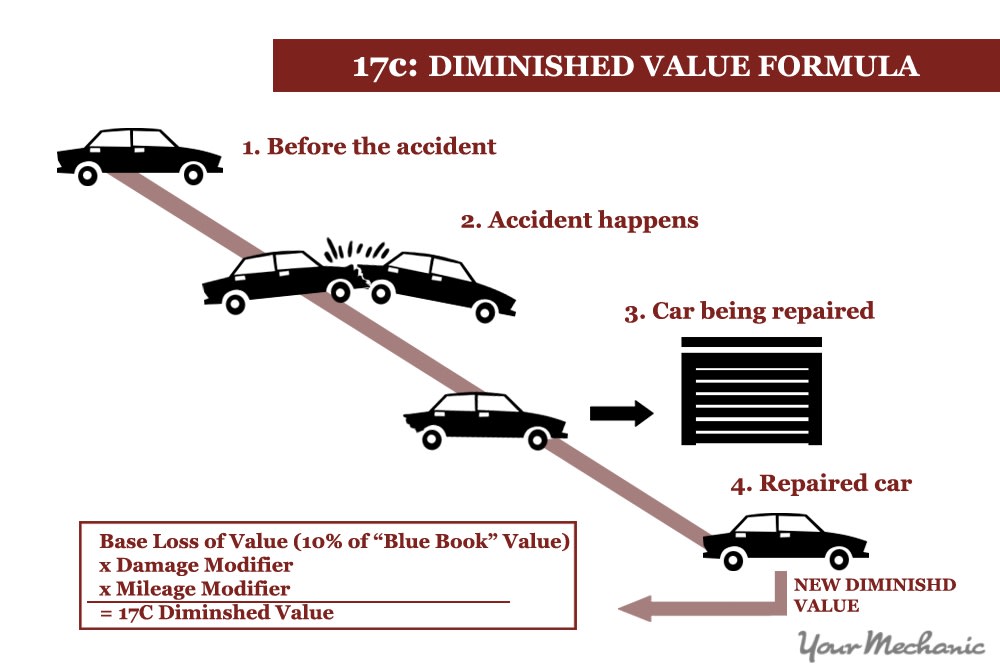

The primary reason an individual would need to calculate the diminished value of a car is to submit an insurance claim after an accident. Naturally, if a car can no longer run or has undergone significant cosmetic damage, it isn’t worth as much.

Regardless of who is at fault or if it is your insurance company or another’s who must reimburse you for the value of your vehicle, it is in the insurance company’s best interest to calculate the lowest value possible for your car.

Most insurance companies use a calculation known as “17c” to arrive at a monetary value for your car in post-wreck condition. This formula was first used in a Georgia claims case involving State Farm and derives its name from where it appeared in the court records for this case – paragraph 17, section c.

Formula 17c was approved for use in that particular case, and it didn’t take long for insurance companies in general to pick up on a tendency to arrive at a relatively low value using that calculation. As a result, the formula was widely adopted as an insurance standard despite the fact it only applied to that one Georgia claims case.

After an accident, however, you will benefit more from a higher diminished value number. That’s why it is important to know both how the insurance company paying your claim will arrive at your car’s current value and its actual value if you were to sell it in its current condition. If, after calculating diminished value for your car in both manners, there is a large discrepancy between the numbers, you may be in a position to negotiate a better deal.

Method 1 of 2: Use formula 17c to learn how insurance companies calculate diminished value

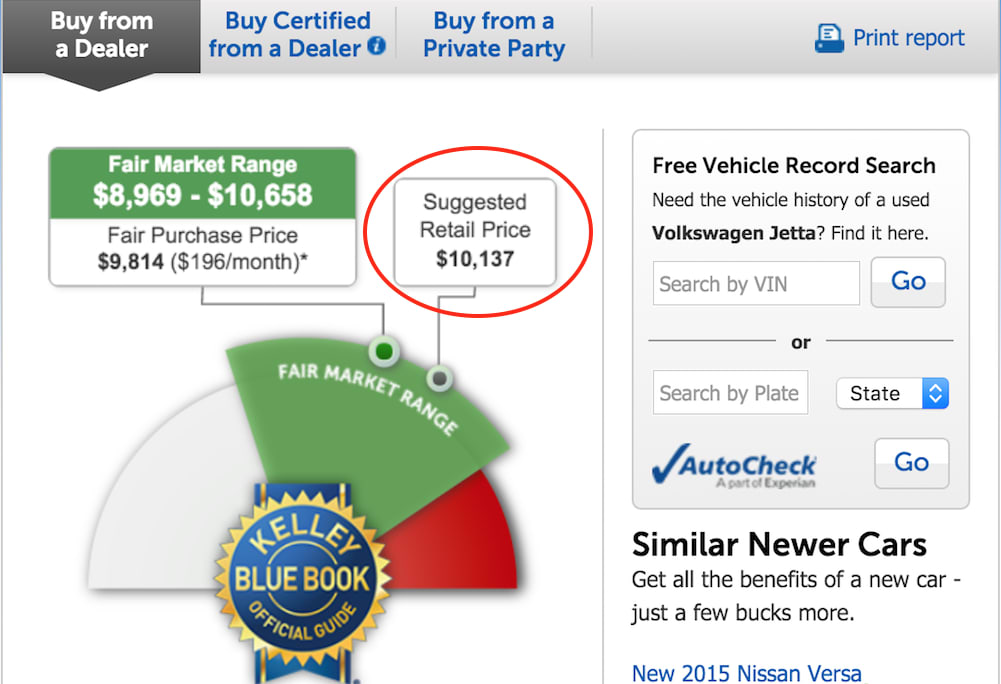

Step 1: Determine the sales value of your car. The sales, or market, value of your car is the amount which NADA or Kelley Blue Book determines your vehicle is worth.

While this is the number most people would think is pertinent, it does not take into account how worth changes from state to state as well as other factors. The number arrived at in the manner is also not in the insurance company’s best interests.

To do this, visit the NADA or Kelley Blue Book website and use the calculator wizard. You will need to know the make and model of your car, its mileage, and a relatively good idea of the extent of damage to your vehicle.

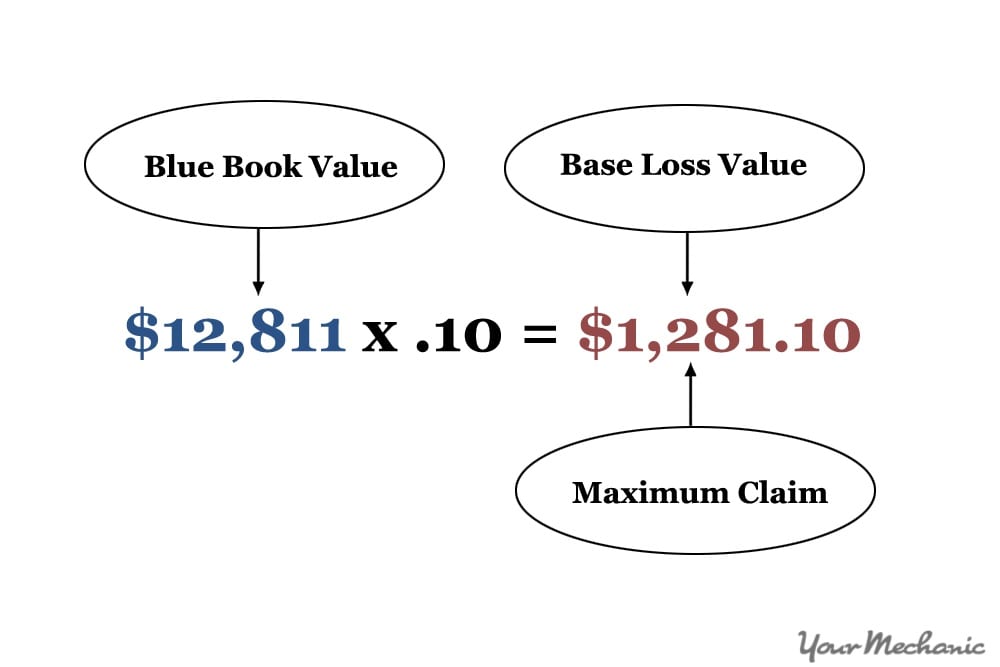

Step 2: Apply a 10% cap to that value. Even in the State Farm claims case in Georgia that introduced the 17c formula, there is no explanation for why 10% of the starting value determined by NADA or Kelley Blue Book comes off automatically, but it is a cap that insurance companies continue to apply.

So, multiply the value at which you arrived through the NADA or Kelley Blue Book calculator by .10. This sets the maximum amount the insurance company can pay on a claim for your car.

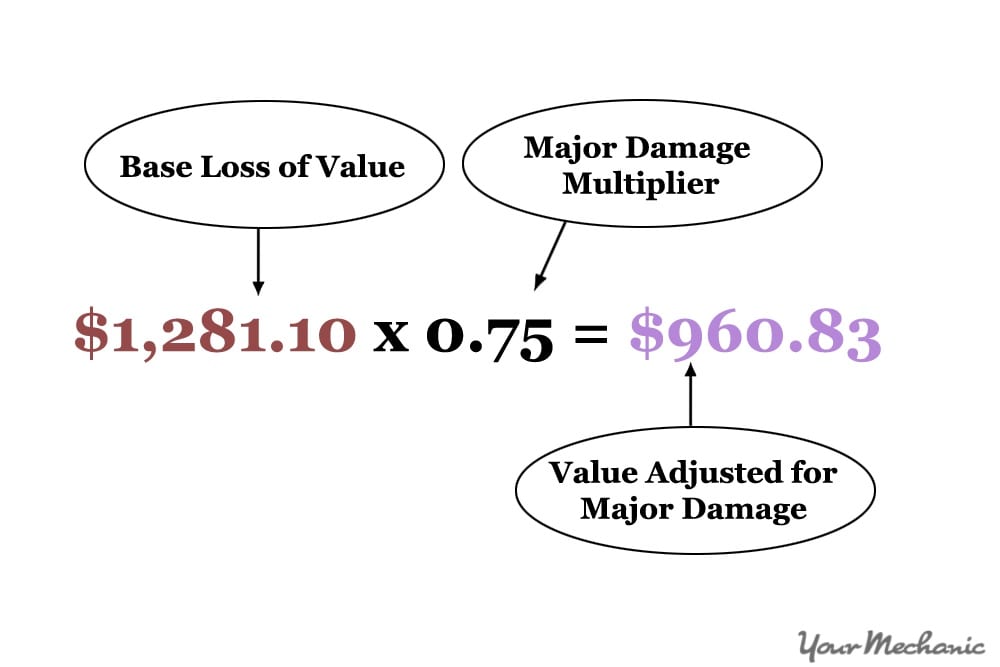

Step 3: Apply a multiplier for the damage. This multiplier adjusts the amount you arrived at in the last step according to the structural damage to your car. It, interestingly, does not take into account mechanical damage.

This has to do with whether parts have to be replaced or repaired on the vehicle; the insurance company only covers what can’t be fixed with a new part.

If you think this is confusing, it is, and it doesn’t provide you compensation for lost sale value. Take the number you arrived at in step two, and multiply it by the following number that best describes the damage to your car:

- 1: severe structural damage

- 0.75: major damage to structure and panels

- 0.50: moderate damage to structure and panels

- 0.25: minor damage to structure and panels

- 0.00: no structural damage or replaced

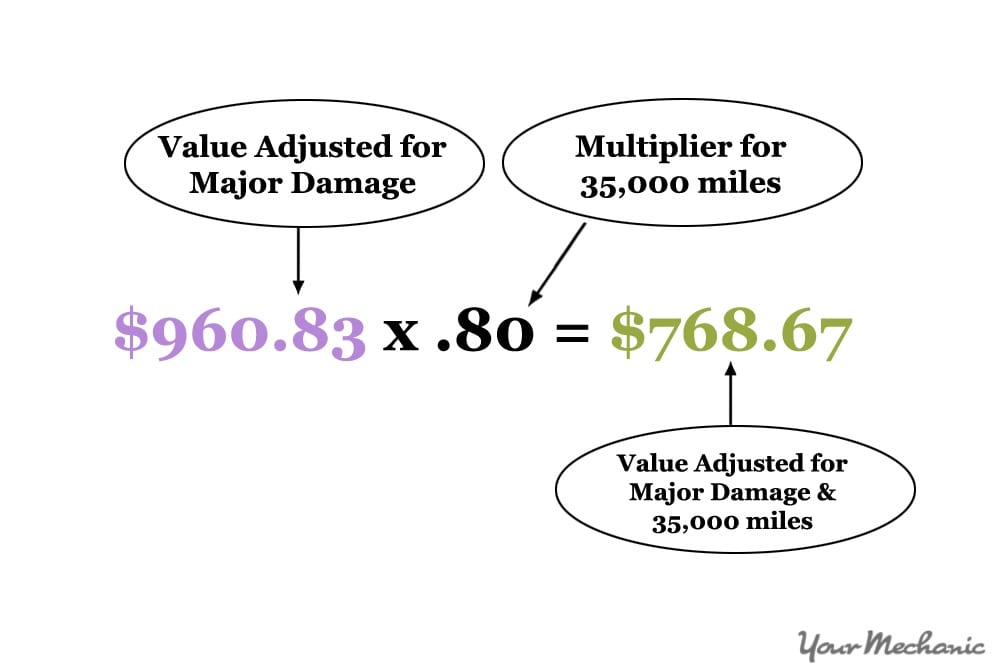

Step 4: Deduct more value for the mileage on your car. While it makes sense that a car with more miles is worth less than the same car with fewer miles, the 17c formula has already taken the mileage into account in the initial value determined by NADA or Kelly Blue Book. Unfortunately, insurance companies deduct value for this twice, and that worth is $0 if your car has more than 100,000 miles on the odometer.

Multiply the number you arrived at in step three by the appropriate number from the list below to arrive at the final diminished value of your car using the 17c formula:

- 1.0: 0-19,999 miles

- 0.80: 20,000-39,999 miles

- 0.60: 40,000-59,999 miles

- 0.40: 60,000-79,999 miles

- 0.20: 80,000-99.999 miles

- 0.00: 100,000+

Method 2 of 2: Calculate Actual Diminished Value

Step 1: Calculate the value of your car before it was damaged. Again, use the calculator on the NADA or Kelley Blue Book site to estimate the value of your car before it was damaged.

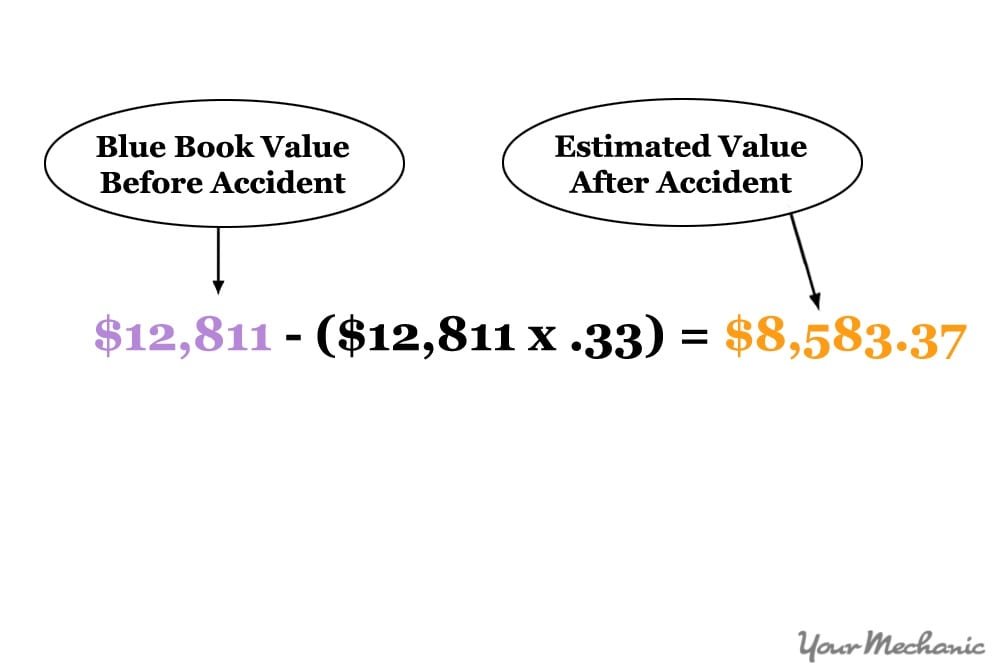

Step 2: Calculate the value of your car after it was damaged. Some law firms multiply the “Blue Book” value by .33, and subtract that amount to find the estimated post-accident value.

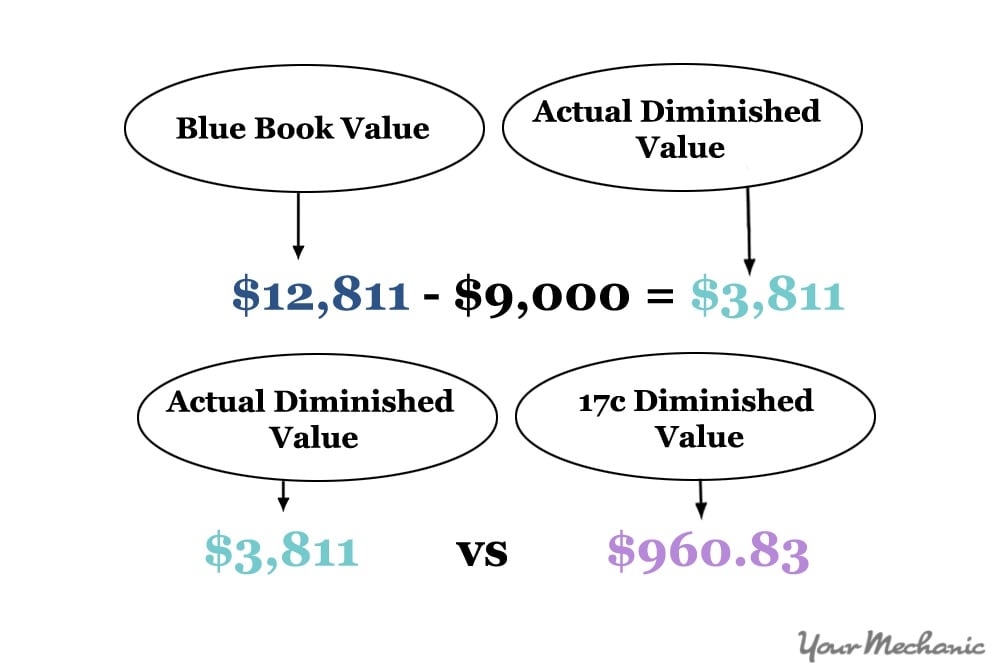

Compare this value with similar cars with accident histories to find an actual value of your car. Say, in this case, similar cars on the market were in a range of $8,000 to $10,000. You might want to even your estimated value after accident out to $9,000

Step 3: Subtract the value of your car post-accident from the value of your car pre-accident. This will give you a good estimation of the actual diminished value of your vehicle.

If the diminished values determined by both methods are wildly different, you may wish to confront the insurance company responsible for reimbursing you for your car’s loss in value as a result of the accident. Bear in mind, however, this will likely slow the payment of your insurance claim and you may even need to hire a lawyer to be successful. Ultimately, you must decide if the extra time and hassle is worth it to you and make an appropriate decision.