When you apply for a car loan, most lenders require proof of income. If you are unable to provide that evidence because you don’t have a job or are self-employed, your options are somewhat limited. However, it is still possible to buy a car even if you don’t have proof of income when you follow some specific steps.

Method 1 of 5: Pay in cash

Out of the options available for buying a car without proof of income, paying with cash is the easiest. Instead of going through the process of finding a willing lender and then providing either collateral or some way to assure a lender that you have the ability to pay, you just buy the vehicle outright. Of course, you have to still sign all of the necessary paperwork and pay taxes on the vehicle, but for the most part, once you pay for the vehicle it is yours.

Step 1: Save your money. The biggest part about paying with cash is saving up the money to do so. The easiest way to save is to put the money you have budgeted toward a car purchase into a savings account.

Step 2: Approach the dealership. Once you have enough money saved, approach the car dealership or private individual and offer to purchase the vehicle.

Make sure to complete all of the other necessary steps when purchasing a vehicle, including checking the vehicle history, taking the vehicle for a test drive, and having it looked at by a mechanic.

Step 3: Write a check. Once satisfied, write a check to the dealer or private individual to cover the entire cost of the vehicle.

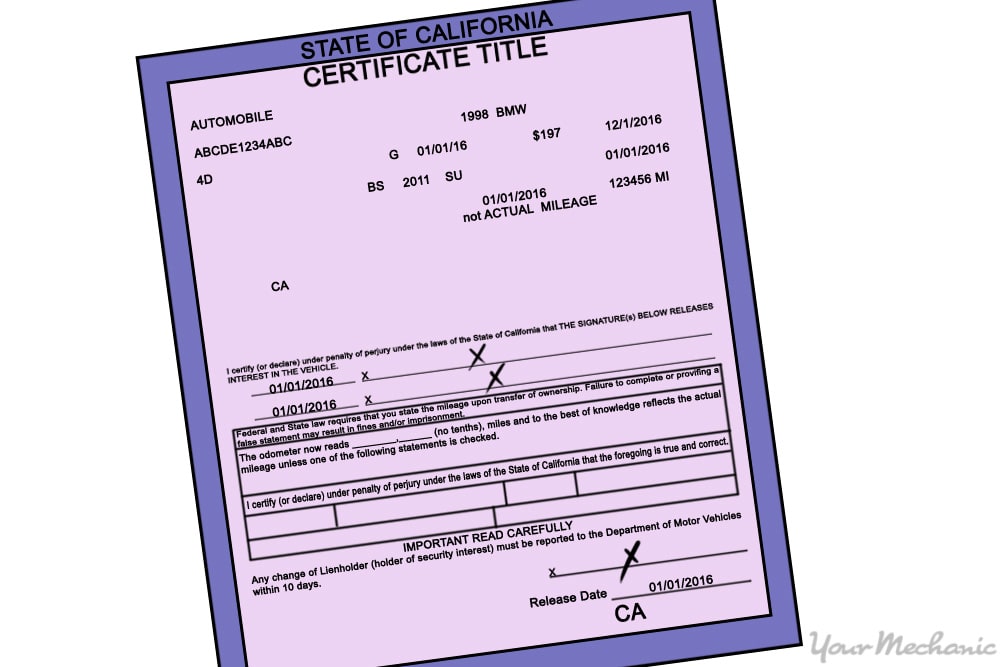

Then it's a matter of signing all of the necessary paperwork and transferring the vehicle title into your name.

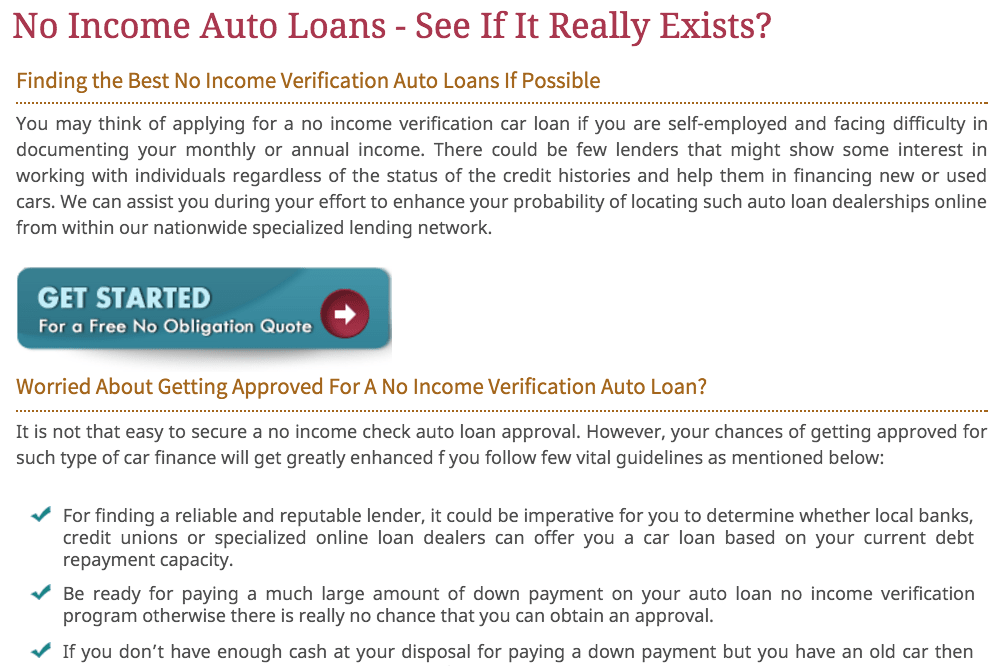

Method 2 of 5: Look for a no-income verification loan

Many lenders are available to finance a car purchase, including those outside of your city or region. You can find many lenders online, giving you even more options for financing.

Step 1: Search online for auto loans. Look for reputable lenders with a good Better Business Bureau rating.

Step 2: Research different kinds of loans. Review the different loan products on sites such as AutoLoans to see which ones are more flexible and have no income verification requirements. These are often referred to as “no-income verification loans.”

Step 3: Apply online. Apply using any online tools that the lender provides. Some of the documents that lenders require instead of proof of income include:

- Copies of your last two years of tax returns

- A valid driver's license

- Your Social Security Number

- Proof of insurance

- A copy of your latest checking account bank statement

Method 3 of 5: Save for a larger down payment

Lenders with more flexible terms often require you to have a larger down payment. This reduces their risk of you defaulting on the loan. In addition to using a trade-in, you can provide cash as a down payment.

Step 1: Pay more in cash. Offer a higher percentage of the down payment in cash, such as 10% or 20%. This gives the lender back more of the cash they invested in the loan up front, and it means you have less to pay off, making it more likely that you will do so.

Step 2: Look for a price tag that’s under $10,000. Look for a lower-priced vehicle or even a used vehicle for under $10,000.

To do so, you can visit most car dealership sites online or sites like cars.com or auto.com.

When selecting the type of car you are looking for, select a maximum price of $10,000. This setup can work nicely as you have less to pay off, decreasing the chances that you might default on the loan.

Step 3: Accept a higher interest rate. Be willing to accept a higher interest rate or shorter loan term.

- Note: A loan with a higher interest rate means more return on investment for the lender from the loan.

A shorter-term loan means that you should have it paid off quickly.

Method 4 of 5: Use collateral

Many lenders ask for pay stubs to verify your income. In instances such as this, you can offer collateral in the form of items worth close to, or exceeding, the vehicle you wish to buy.

Step 1: Prepare your collateral. To use collateral, you first need to show ownership of other assets you can use as collateral. Items that you can use as collateral include:

- Automobile titles

- Real estate deeds

- Cash account statements

- Machinery and equipment receipts

- Investment statements

- Insurance policies

- Valuables and collectibles

Any future payments from your customers if you own a business

Tip: If you don’t have a job but are able to pay back the loan through other means, such as alimony or disability payments, you need to prove that documentation as well. It often helps to have several months of car payments in the bank or a savings account with a substantial balance.

If you plan on using a piece of property or another vehicle as collateral, the lender will take out a lien. This gives the lender the right to keep your property if you default on the loan.

- Warning: Keep in mind that, according to federal law, you have up to three days to cancel a loan without penalty. When cancelling a loan, remember that business days include Saturday, but not Sunday or a legal public holiday.

Method 5 of 5: Get a co-signer

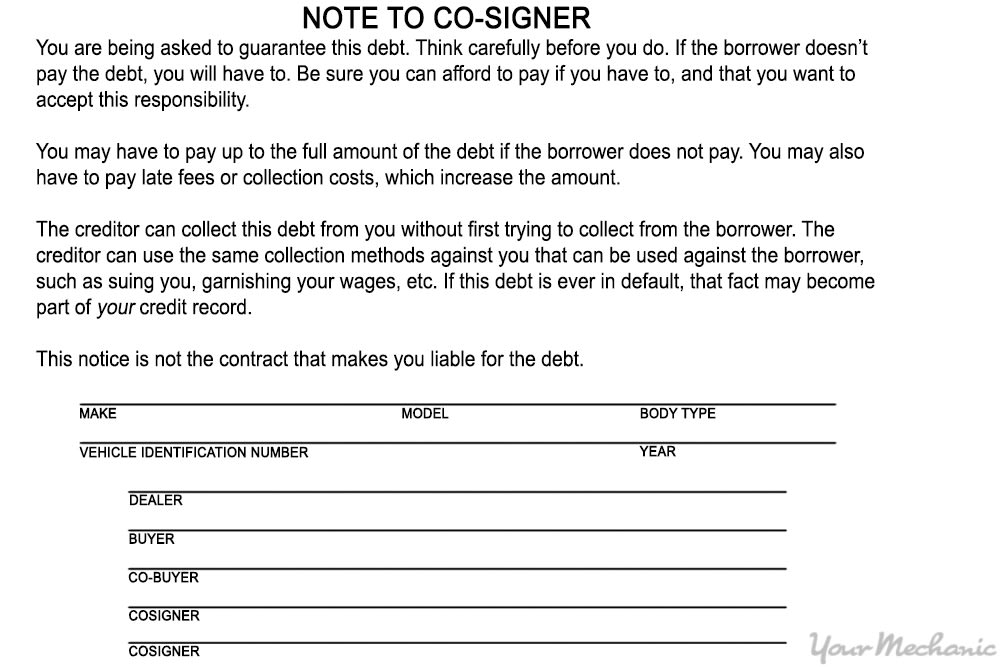

A co-signer is another way to get a loan without having to show proof of income. But make sure to pay off any loan you have a c-osigner for, or they will be responsible for what you owe on the loan.

Step 1: Find a responsible co-signer. Ask a family member to cosign the car loan with you. Make sure they have proof of income and are willing to be a cosigner. A cosigner is someone who is responsible for your loan if for some reason you fail to pay.

Make sure your co-signer is aware of his or her responsibilities. Some co-signers may not know that they are going to be held responsible for the amount you borrowed if you do not pay on time.

Step 2: Find a lender. Find a lender who is willing to accept a co-signer as the sole means of income for your loan. Keep in mind that the lender will do a credit check on the co-signer, so find someone who has good credit to cosign for you.

Finding a lender to give you a loan on a car when you have no proof of income might seem impossible, but luckily you have a few options you can fall back on. These standby methods include finding a cosigner, using collateral, paying a higher down payment, or paying for the vehicle outright. Just remember to have the vehicle inspected before buying it.