The Annual Percentage Rate (APR) of your car loan is the yearly interest rate on any money you borrow from a lender. The APR includes such things as the principal, any taxes on the vehicle, and any interest and pre-paid finance charges that are a part of your loan.

A low APR on a car loan saves you money with your monthly payments and on the total amount paid in interest. It takes a bit of research, but you should find the best APR before you settle on a loan.

Part 1 of 3: Research your options

The first step when searching for a low APR is to research your options. Part of this includes getting a credit report and learning your credit score. Your credit score is one of the biggest influences on the APR for which you qualify. Some other items to research include comparing the interest rates offered by the various lenders you are interested in using and finding out how vehicle age, type, and other factors can affect the APR.

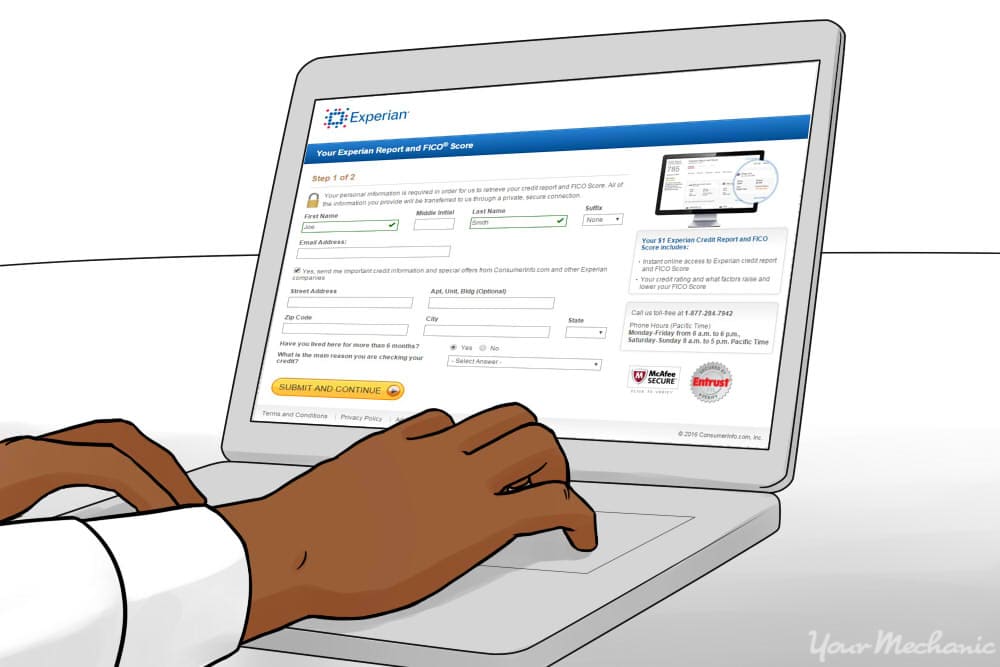

Step 1: Get your credit report. Start by getting a copy of your credit report from annualcreditreport.com, a site set up by the three national credit reporting agencies to supply free credit reports to consumers, as required by federal law.

- Check it to see if you have any late payments, collections, or other negative information. Make sure it is accurate and free of errors.

Step 2: Check your credit score. Federal law dictates that the three national credit reporting agencies have to each give you one free credit report per year. Any more than that and you have to pay.

Alternatively, you can sign up for credit monitoring at one of the free credit sites, such as Credit Sesame or Credit Karma.

Note: While the credit score you receive won’t always be exactly same, it can give you an idea of your credit score.

Step 3: Check with your credit card company. Another option is to check with your credit card company to see if they provide free credit scoring information. Many credit card companies do this as a service to their card holders.

Step 4: Compare interest rates with various lenders. Find out the best rates available.

Step 5: Gather your paperwork. Get all required paperwork together to take to a lender. Loans with low documentation requirements often come with a higher interest rate.

Step 6: Consider two or three models of vehicles. Certain models may come with a higher interest rate.

Part 2 of 3: Shop around for interest rates

Once you know your credit score, compare the interest rates offered by the lenders you are interested in using. Among the various lenders you are looking at, find the best rates and terms available.

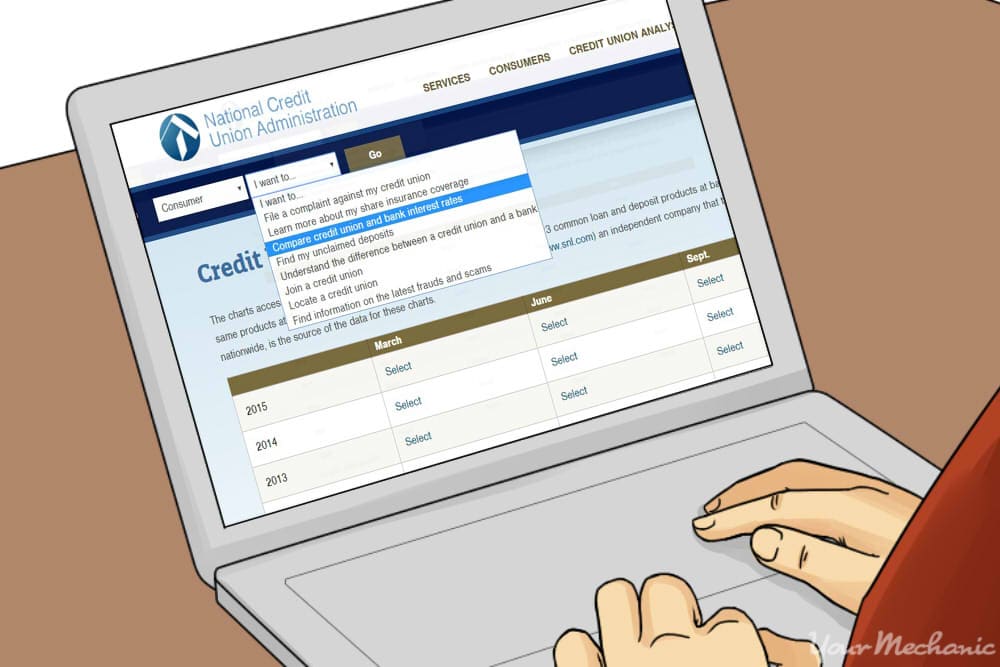

Step 1: Ask your bank. Talk to your local bank to find out the interest rate they can give you. You can also check with local credit unions. Their interest rates are often slightly lower than traditional banks.

Step 2: Call dealerships. Find out the interest rates of various car dealers in town by calling and asking to talk to the finance department.

- Car dealers often offer special deals, including rebates, and have some of the best financing terms available.

Step 3: Shop online for auto loans. Because you can provide all documentation online, you aren’t limited to local financial institutions.

Part 3 of 3: Get financing in place

Now that you have chosen a potential lender, get all of the required paperwork together to take to the lender you chose. Keep in mind that loans with low documentation requirements often come with a higher interest rate.

Step 1: Get a loan. Get pre-approved for a loan before shopping for a vehicle. This allows you to focus only on the vehicles that fall within the amount you can borrow.

- Even if you don’t decide to go with this lender, you can use the pre-approval as a negotiation tool.

Step 2: Choose your term length. Select a shorter term for your car loan, which often comes with a lower APR.

- The bad thing about a short-term loan, though, are the higher monthly payments. But if you are okay with paying a higher price, then this is a good option.

Step 3: Ask a dealer to beat your pre-approval. Take your pre-approval to a car dealer to see if they can beat the terms. Most dealers want to make a sale so they might lower the APR they are offering in order to get you to finance your vehicle through them.

Step 4: Pay more up front. Increase your down payment to give you more room for negotiation.

- By increasing the amount you pay up front, you decrease the amount you need to have financed. Couple that with a lower APR, and you can greatly reduce the amount you pay over the term of the loan.

Step 5: Ask about rebates. Find out if you can exchange some of the included bonuses given with a car for a lower APR. This may include cash rebates or special packages, which you can do without.

- Tip: If you can’t get a low interest rate now and you need the car, choose the best loan and then refinance in six months for a better rate. By refinancing to a lower interest rate, you can save big, especially if the interest rate falls by a full point or two.

Step 6: Consider two or three models of vehicles. Certain models may come with a higher interest rate.

Finding a loan with a low APR is one sure way to save money when financing a vehicle. Just remember to have a pre-purchase car inspection performed by one of our expert mechanics before buying a used vehicle.